For some of the 370,000 Woolworths shareholders, the $2 billion off-market share buyback is an absolute bonanza. It is a “no brainer”. Because of the lower capital component and higher franked dividend, it is even more attractive than CBA’s $6 billion share buyback (which closes on Friday).

In this article, I will crunch the numbers to show who should accept and who shouldn’t accept. And if you do accept, what are your options about re-investing the cash?

Before we get to the numbers, a re-cap on what makes ‘off-market’ share buybacks special, and how Woolworths has structured this buyback.

What’s special about an ‘off-market’ buyback?

There are 2 main types of buybacks. An ‘on-market’ buyback is conducted on behalf of the company by a broker purchasing the shares on the ASX. The other type is an ‘off-market’ buyback. This is conducted through a tender process and provided it is an equal access scheme, allows a company to distribute surplus franking credits to its shareholders.

It is this distribution of franking credits that makes the ‘off-market’ buyback special. Part of the sale proceeds is treated as a franked dividend, with the other part treated as a capital component. Effectively, the shareholder gets a super-sized dividend with franking credits, and a materially reduced sale price for capital gains tax purposes. This makes the ‘off market’ buyback tax advantageous to some shareholders, and because they are keen to accept, means that the company can purchase the shares at a discount to the market price on the ASX.

Woolworths ‘off-market’ buyback

Shareholders will be offered the opportunity to participate and tender all, some or none of their shares, with the tender closing at 7pm on Friday 15 October.

The tender will be at a discount to the market price, in a range from 10% up to a maximum discount of 14%. Because the buyback is capped (the $2 billion represents about 4.6% of Woolworths ordinary shares), Woolworths will accept tenders from those shareholders offering to sell at the lowest price (highest discount) and reject those offering to sell at a higher price (lower discount).

The buyback price comprises two components – a capital component of $4.31 and the balance as a fully franked dividend. If the market price of Woolworths shares is (for example) $40 and the tender discount is 14%, then the buy-back price will be $34.40. This will comprise a capital component of $4.31 and a fully franked dividend of $30.09 per share.

The buy-back price will be the same for all tenders – so if the buyback is cleared at a discount of 10% (which in this case is highly unlikely), shareholders who nominate discounts of 11%, 12%, 13%, 14% will be successful and receive the price at a 10% discount. Rather than nominate a % discount, shareholders can also tender ‘final price’ (take whatever the market clears at). As a scale-back on a pro-rata basis is likely, Woolworths has announced some priority rules – an allocation to each successful tenderer for their first 180 shares.

The market price will be determined by calculating the volume weighted average price of trades on the ASX over the 5 trading days immediately before the closing day, i.e. from 11 October to 15 October. The announcement of the buy-back price and any scale back will be made on Monday 18 October.

Shareholders worried about Woolworths share price during the buy-back period can optionally set a minimum price (between $32.00 and $35.00). If your tender discount is successful (this also includes ‘final price’ offers), you will only be accepted if the buy-back price is equal to or above your minimum price.

Should you accept?

The premise is that you should accept the buyback if your effective sale price (after tax) is higher than you could achieve by selling the same shares on the ASX. If you feel that you want to maintain your Woolworths shareholding, you just buy them back on the ASX.

Let’s compare the two alternatives – selling your shares on market at $40 or selling your shares in the buyback.

We will do this from the perspective of a SMSF in pension phase paying tax at 0%, a super fund in the accumulation phase paying tax at 15%, and an individual paying tax at the highest marginal tax rate of 47%.

Because we need to consider the impact of capital gains tax, we will demonstrate the outcome where the shares were purchased for $15.00, and also where the shares were purchased for $30.00.

We will also make these assumptions:

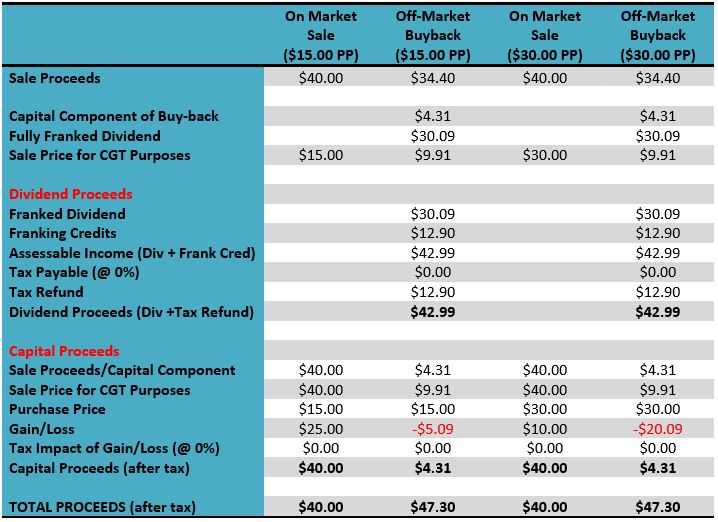

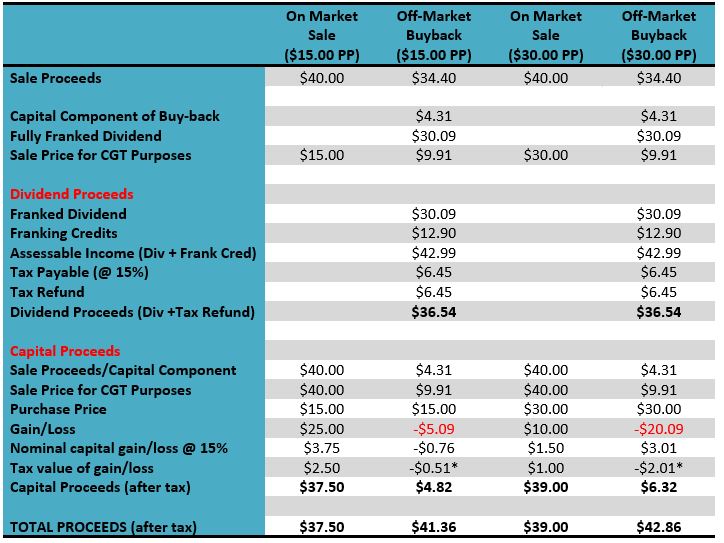

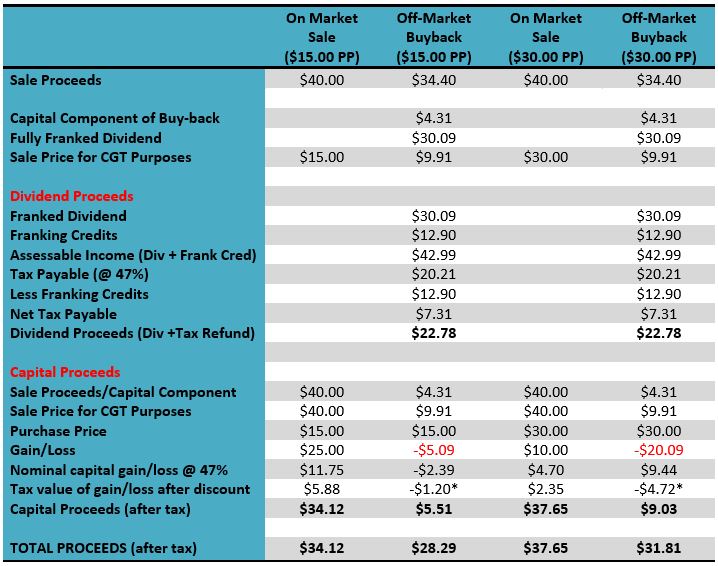

Three examples are shown:

In each example, there are two purchase prices: $15 and $30. Columns 2 and 3 compare the after tax proceeds of an on-market sale at $40 and participation in the buyback, assuming a purchase price of $15, and columns 4 and 5 compare the after tax proceeds of an on-market sale at $40 and participation in the buyback, assuming a purchase price of $30.

The total proceeds is the sum of the dividend component and the capital proceeds.

In the first example, because the tax rate is 0%, the franking credits are fully refundable in cash. There is no tax to pay on any capital gain, or opportunity to apply a capital loss to offset another capital gain.

Example 1 – 0% taxpayer

In the second example, the tax rate is 15%. Effectively, half the franking credits are available as a tax refund (with no tax to pay on the dividend). On the capital side, after application of the one-third CGT discount, gains are taxed at 10% and the value of a capital loss to offset another capital gain is also 10% of the loss.

Example 2 – 15% taxpayer (assumed to be a super fund)

In the third example below, the tax rate is 47%. There is net tax to pay on the fully franked dividend. On the capital side, after application of the 50% CGT discount, gains are taxed at 23.5% and the value of a capital loss to offset another capital gain is 23.5% of the loss.

Example 3 – 47% taxpayer

Conclusion

For a 0% taxpayer, such as an SMSF in pension phase or an individual who has income under the tax free threshold of $19,200, it is an absolute “no-brainer” to accept. The effective selling price is $47.30 ………..$7.30 or 18.25% higher than the market price!

For a SMSF or super fund in the accumulation phase paying tax at 15%, it is moderately attractive. It is potentially worth up to $3.86 if you can utilize the capital loss to offset tax payable on other capital gains or were planning to sell on market in any event. If you will shortly rollover into the pension phase (where your SMSF will be paying tax at 0%), acceptance is fairly marginal.

If your fund is part pension/part accumulation, it will generally make sense to accept – the higher the proportion in pension, the more attractive it will be.

For those paying tax at a marginal tax rate of 34.5% or higher (the rate kicks in when your taxable income exceeds $45,000), don’t even bother to open the buyback offer document – throw it in the WPB. This ‘off-market’ buyback won’t work!

l expect that the Woolworths buyback will go the way of most other ‘off-market’ share buybacks and be heavily oversubscribed and hence subject to a scale back. The buyback discount will be 14%. As all successful tenders receive the same sale price, if you want your tender to be accepted, either tender ‘14%’or ‘final price’.

From a tax point of view, it is very clear as to who should accept and who shouldn’t.

Finally, if you do plan to accept, a critical decision is what to do with the money. Do you re-invest in Woolworths and buy on the ASX the shares you sold into the buyback? Do you do this before the buyback is completed (potentially taking some risk on the scale back and final market price), or do you wait till the result is announced and payment is received on 21 October? Alternatively, do you say that Woolworths is expensive, and invest those monies into one of the other major consumer staples companies such as Coles (COL) or Metcash (MTS). Or do you lighten up on consumer staples and move into another sector, or just reduce your overall equities exposure?