When I get a break from my usual routine in Australia and get a chance to holiday in places like the Peloponnese in Greece, where I am now, and where the daily routine is swimming and eating in wonderful beach-based tavernas, I actually read books.

Oh yes, I don’t get a total break, as you can see but that’s the occupational hazard of being Peter Switzer.

Call me over-exposed to money, business and success stories but I’ve long avoided escapist novels such the Da Vinci Code, which I loved when I read it years ago, but now I want to learn from legends.

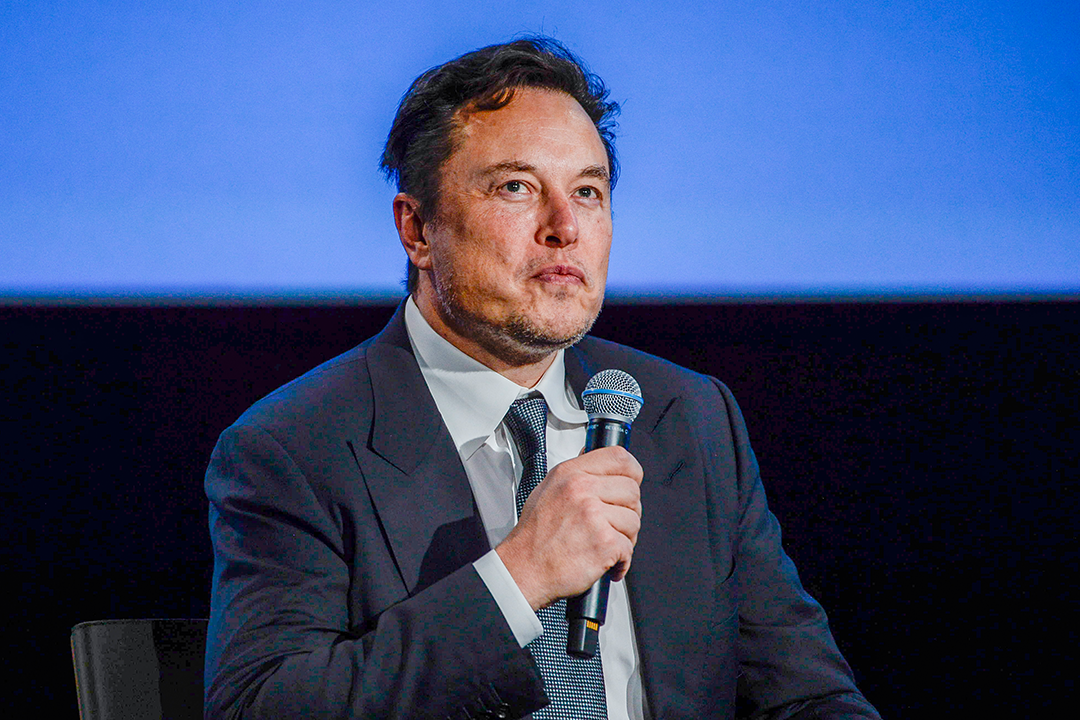

And the legend I took with me on this Greek odyssey — or is it a geek odyssey? — was Elon Musk via the writings of US journalist, Ashlee Vance in his New York Times Best Seller, ELON MUSK: HOW THE BILLIONAIRE CEO OF SPACEX AND TESLA IS SHAPING OUR FUTURE.

Vance, like Walter Isaacson in his great book Steve Jobs, doesn’t try to teach people, like me, what these great business builders did to succeed, instead they tell a story and you have to draw out the lessons.

The characteristics of the likes of Musk and Jobs are often similar — unlike many of the Greeks at Grexit, they are workaholics. Both these two guys were headstrong and quite ruthless with people, especially those who were not as committed as them. They wanted to create something unique, purposeful and hugely successful and they were not afraid to take on huge rivals such as Microsoft and IBM, in the case of Jobs and the big car companies of the world and governments of the US and Russia when it came to rockets!

Did I say these guys were unique? And it was their drive to build the incredible that was a huge lesson in itself for anyone who wants to achieve something special.

The book on Musk is an important read for anyone trying to build an enduring business, but I think what you learn about him can be valuable for anyone wanting to be a successful wealth-builder in general.

Business-building and wealth-building actually can use the same building blocks and Musk certainly reminded me of something I learnt over the years, which now influences how I invest.

So, let me link what I’ve learnt from the brains behind Tesla. By the way, he was not the founder, but it would never have been the success it has become without this very odd South African-raised man, whose family actually hailed from Canada and the US.

History records that South Africa and its sporting madness did not suit the bookish Musk, who actually read every book in his school library and had to petition the librarian to get more books!

When that did not happen as he wanted, he turned to devouring the Encyclopaedia Britannica, and armed with his photographic memory he ended up very bright!

The Musk story was one of a very successful entrepreneur. He started the online business directory Zip2, which was sold to Compaq for $US307 million and that money rolled into X.com, which merged with rival PayPal leaving Elon as the major shareholder. When it was sold to eBay for $US1.5 billion, it was a big payday for Elon.

In fact, he’s had trouble with his business partners but he’s still made a lot of money with his net worth now at $263.7 billion, despite his hassles with his Twitter purchase and the slide in the price of bitcoin.

I suggest you learn this from Musk when it comes to money and investing:

If you ask these questions, like Musk continually asked of his business and his team, then you will end up with a number of investments that will make you look like a real professional.

One last tip for you to assess yourself and your approach to investing. When Musk decided to invest in his rocket business — SpaceX — he read everything that had ever been written by credible rocket scientists and engineers, such that pros in famous rocket businesses such as Boeing and Lockheed Martin, were staggered at his knowledge.

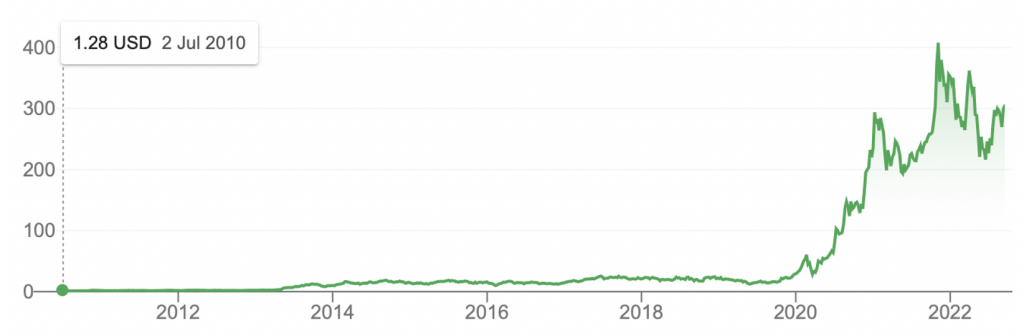

That’s the standard a great investor should set for him- or herself, and it will ensure great returns of Tesla proportions down the track.

This chart proves my point.

Tesla (TLSA)

Learn from Elon Musk and even Steve Jobs and you could easily end up with returns like the ones shown on the chart above or the one below for Apple.

Apple Inc (AAPL)