Life360 (ASX:360) is a San Francisco-based IT company that connects and protects loved ones through a variety of safety features, all conveniently located in one app for a fraction of their traditional costs. In addition to the free option, there are three membership plans that provide families peace of mind while on the go, on the road and online. Valued core offerings include: advanced location sharing on a private map, smart notifications when family members come and go from designated destinations, phone battery updates, driving reports to monitor safe driving behaviour, 24/7 roadside assistance, and crash detection with emergency response.

The company’s membership model launched in the US market in June 2020, expanding beyond Life360’s location-centric features to incorporate identity theft protection, SOS with emergency dispatch, and disaster, medical and travel assistance. This suite of membership services now allows Life360 to meet the needs of every family lifestage.

As of June 2020, Life360 had 25 million monthly active users across 195 countries, in 13 languages, and 845,000 Paying Circles (subscribers).

The company listed on the ASX on 5 May 2019 and raised $145 million from its IPO with a market capitalisation above $600 million. Its share price surged 10.9% on the first day of trade. On 10 May 2019, the Australian Financial Review reported “the float was the ASX’s biggest tech raising since WiseTech Global’s 2016 float.”

The app was founded in 2008 by co-founders Chris Hulls (CEO) and Alex Haro (Non-executive Director).

As well as co-founding Life360, Hulls has been an angel investor and advisor for a number of tech companies, including Tile, Credible, Ring, Automatic, Honk and Zendrive, while Haro worked on the Orbited project that allows real-time browser communication.

In 2019, Hulls told CNBC that Life360 chose not to list in the US to avoid Wall Street’s “swirl of noise”.

“People think of Australia as a small little country, but in terms of investable capital, it’s massively disproportionate to their population,” he said.

The company has five independent non-executive directors across the US and Australia. David Wiadrowski and James Synge are the Australian-based directors. Over the course of 2020, James Synge invested an additional $256,000 into the stock increasing his shareholding to 1.2%. Life360’s “insider ownership” is roughly 10%, according to Yahoo! Finance.

In July 2020, in an article he wrote in the Switzer Report, Tony Featherstone tipped Life360 (ASX: 360) as one of his “2 transport small caps that could benefit from COVID-19”. Featherstone shared his personal experience with the app, which he and his family have used for several years. “Watch more parents register for Life360’s free and paid services during and after COVID-19. Parents will worry more about children using public-transport services that have a higher risk of disruption. Technology that shows when their children have boarded public transport appeals.”

Like all young companies, Life360 has had its hurdles, which Featherstone described in his article as “disgruntled young people who do not like their parents tracking them”. “After hearing teens vocalize their feelings very publicly about Life360 on TikTok, we decided to reach out to them and open a dialogue to really hear what they had to say,” said CEO Chris Hulls to BusinessWire. “Teens are a core part of the family unit - and our user base - and we value their input. After months of communicating with teens, I am proud to launch a feature that was designed with them in mind, continuing our mission of redefining how safety is delivered to families.”

This new feature is called “Bubbles” and, when activated, shows a general radius rather than exact location to respect privacy, while ensuring the app can still achieve its main objective of safely monitoring and connecting loved ones. The company has also committed to bridging the communication gap between parents, teenagers, and technology by producing content and offering resources from Life360 Family Expert, registered psychologist and parenting educator, Dr Vanessa Lapoint.

In June 2020, Life360’s annualised monthly revenue was up 26% to US$77.9 million and subscriber growth picked up post-COVID in April. In the CY20 H1 Results report, the company said this reflected its “resilient” business model.

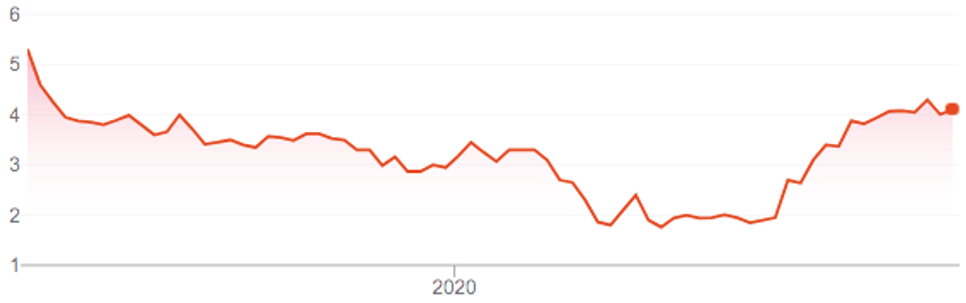

As the chart below shows, this year Life360’s share price has rallied from its March 23 COVID-lows, when it dropped to around $1.50, to then reach a high of $4.49 on September 8.

This article is sponsored content. The supplier of this content has a commercial arrangement with Switzer Financial Group.