A super crunch is coming and it will be a squeeze play for many people who have played by the rules first created by Paul Keating, which then were changed by Peter Costello, Wayne Swan, Joe Hockey, Scott Morrison, Josh Frydenberg and now Jim Chalmers. These have all been aided and abetted by their respective Assistant Treasurers or Financial Services Ministers and of their respective Prime Ministers.

And if the changes to super expected to be outlined in the May Budget turn out to be draconian to many Aussies who’ve built up their super funds over the years and who follow the rules, then Albo, in their eyes, could be seen as the Prime Monster!

In a perfect world, Albo and Jim might come up with a ‘fair enough’ change to super, given the state of the Budget post-pandemic, and given how the tax concessions are likely to hit the Budget bottom line in coming years.

The changes coming will have significant implications for who will win the next election. If the promised reforms end up as hard-hitting as some experts are alluding to, then Peter Dutton might become electable!

And I didn’t think I’d ever write something like that!

The dilemma for the Government is that it must hit enough people to collect sufficient tax to help the Budget and to justify this potentially problematic political decision.

It’s easy for Labor to go after the 11,000 people with $5 million or more in super, as most of these people would never vote for Albo’s team.

“The cash-strapped Commonwealth budget would get a $1.5 billion annual boost if the Albanese government put a $5 million limit on the amount of superannuation people can accrue, according to one of the industry’s peak lobby groups,” the AFR’s Michael Reed tells us.

By the way, the Financial Services Council (FSC) thinks the number is more like 16,500. So, in coming months, we’ll hear a lot of stuff about super to make Government changes understandable such as:

1. Analysis by financial institution, Mercer, found the tax concessions accruing to a person with $10 million in superannuation would fund 3.1 full age pensions.

2. The Morrison government’s retirement income review found a person with a superannuation balance of $5 million could achieve annual earnings tax concessions of about $70,000.

3. Thirty-two of Australia’s biggest SMSFs held more than $100 million each in concessionally-taxed savings in the 2020 financial year, including one mega-SMSF with $401 million. Experts estimate taxpayers spend $200 million a year on tax concessions for the 100 largest SMSFs.

4. By 2050, the government will be paying more in super tax concessions than it is on the aged pension, which is the largest government welfare payment.

5. The average superannuation balance is $150,000 but this average is reduced by the number of young people with small balances and those older people who were late to super either in poorly paid jobs or because they were mums at home or had divorces.

6. The Grattan Institute says two-thirds of Australians have less than $100,000 in super, while about 80,000 people have more than $2 million in their accounts.

7. Two-thirds of the value of the super-related tax concessions goes to the top 20% of income earners.

8. Older Australians earning upwards of $100,000 a year can opt out of the income tax system at the age of 60, while younger Australians earning $100,000 pay $23,000 in tax.

So, what changes look likely? Right now, a super pension account can’t be over $1.7 million, unless it grows over that amount via successful investments.

If someone had $2 million in their super account, $1.7 million can go into pension mode and the income earnt would be tax free. The other $300,000 remains in an accumulation super account and the earnings are taxed at 15%.

This could be bumped up to 30% by the Treasurer in May, or even taken to the top rate of 45%.

The first option would raise about $1.5 billion for the Budget but the Government might want more than that. On the other hand, once they change the tax on monies over the pension cap and in accumulation mode, the tax rate can be lifted in the future.

This will become an ugly debate about money. One side will argue what Brendan Coates, the Grattan Institute’s economic policy program director has said: “Super is becoming a taxpayer-funded inheritance scheme for wealthy Australians. And that’s clearly not what it is intended to be.”

While others will say these people followed the rules and their advisers did the right thing giving them the best advice given the rules. In fact, by law their advisers had to inform them of their tax-effective wealth-building options.

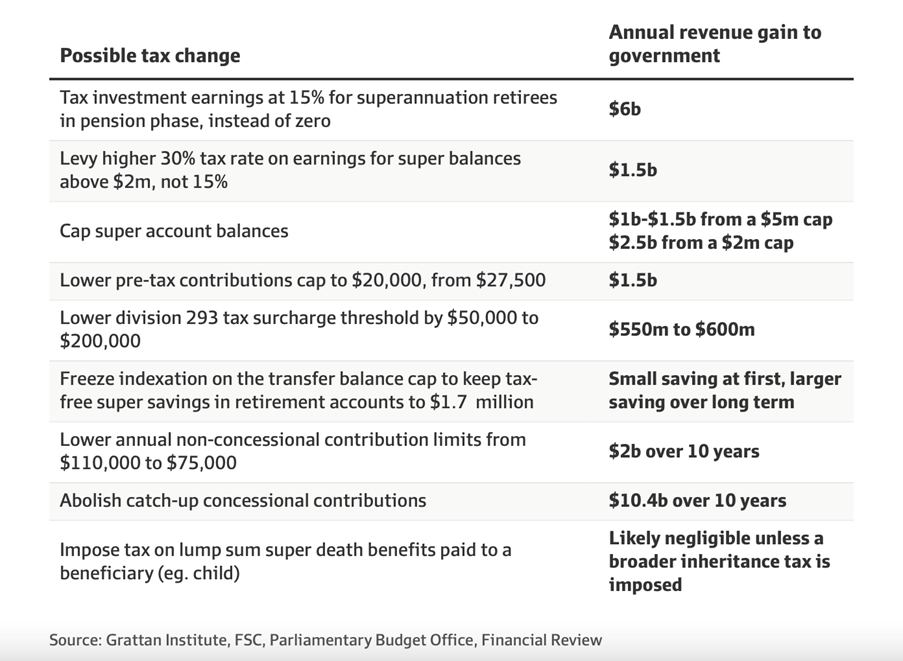

The AFR presented all the options on the table for the Government and what’s possible will scare a lot of Aussies who committed themselves to super at previous governments’ behests. See them below.

The big complaint many of these super successful super players might genuinely have is that if we hadn’t been encouraged into super with generous tax concessions, we might have invested in property, diamonds, businesses or who knows what?

I’ve been a super fan for decades but the criticism I have often heard has been: “The problem with super is that governments always want to change the rules.”

I suspect a mother of all rule changes is on the cards. The big mystery will be about how many Aussies are going to be hip pocket affected.

And the bigger mystery will be how will voters react to these changes in the 2025 election, or before?