The past six months have seen mass

movement in the share market, with investors grappling with how to best

organise their portfolios in the midst of a sudden global economic downturn.

This includes self-managed super fund (SMSF) trustees, some of whom have needed

to quickly re-evaluate their investment strategy to stem losses from plummeting

share markets.

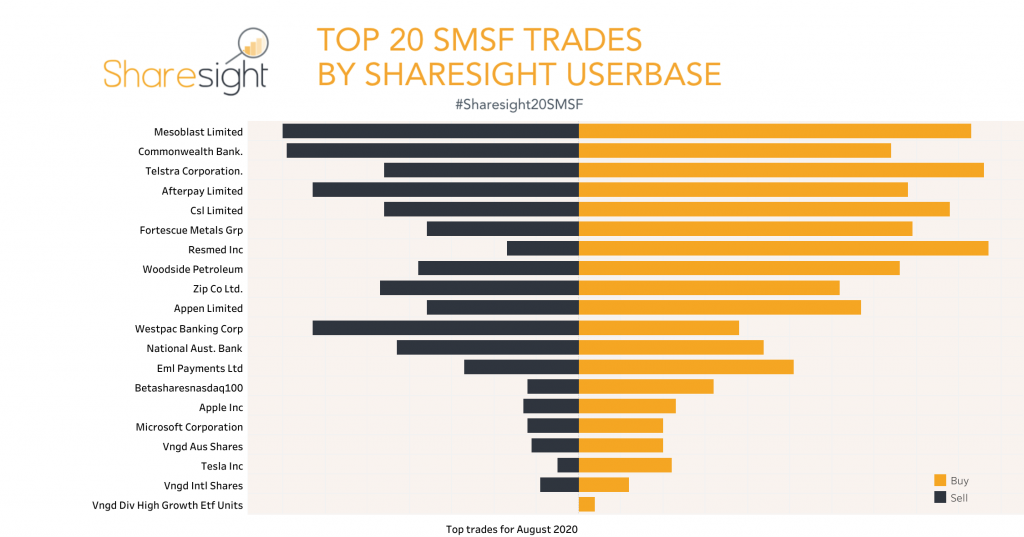

Each month, Sharesight highlights the

top 20 stocks traded by its users in a range of global markets, and the

market-moving news behind them. This article details the top 20 buy and sell

trades made by SMSFs in August 2020. To find out the news behind these stocks,

keep reading.

The top

trades by SMSFs in August

Many investors use Sharesight’s

portfolio tracker to track the assets in their SMSF, as it allows them to track

the performance of investments in global markets and a range of asset classes.

As can be seen in the chart above, the month of August saw wide-ranging

investments by SMSFs, with Mesoblast (ASX: MSB) and Commonwealth Bank (ASX:

CBA) leading in both buy and sell trades, while investors also favoured Resmed

(ASX: RMD), Afterpay (ASX: APT) and CSL (ASX: CSL). Here’s the news behind some

of August’s most interesting stocks:

- Mesoblast (ASX: MSB) is a growing Australian biotech company that has seen surging share prices and a 90% increase in its revenue over the past year. The next few months will be critical for Mesoblast; the company is seeking FDA approval for its stem cell treatment, and is planning to launch a drug to treat Covid-19 complications by the end of 2020.

- Commonwealth Bank (ASX: CBA) has always been a popular dividend stock for investors, although it has more recently become synonymous with scandal, being fined $700 million over money laundering allegations in 2018. Things may be looking up for CommBank; ASIC has dropped its follow-up investigation into the scandal, and the bank produced a higher-than-expected dividend despite falling profits due to Covid-19.

- Afterpay (ASX: APT)

has taken the investment world by storm with its rapid expansion and

skyrocketing share prices. In the past month, the BNPL giant announced an $80 million European expansion deal, not to mention doubling its expected earnings for FY20. On the back of this news, Afterpay’s

share price hit an all-time high at the end of August, bringing the company’s

market cap up to $25.9 billion.

- CSL (ASX: CSL)

has seen strong growth in its share price over the past few years, becoming a

portfolio staple for many Australian investors. The biotech company continues

to see success, posting strong FY20 results and increasing its dividend payout, while also being the most likely candidate to manufacture Australia’s Covid-19 vaccine. The company has flagged a soft FY21,

however.

- Apple (NASDAQ:

AAPL) has long been an investor favourite due to skyrocketing share prices that

really took off after the first iPhone was released in 2007. The tech giant has

continued to flourish throughout the pandemic, gaining $1 trillion in value since the NASDAQ bottomed out on March 23 this

year. Apple has since become the first US company to hit a $2 trillion market cap, and saw its stock price rise to an all-time high before a

4-for-1 stock split on August 31.

- Fortescue Metals (ASX: FMG)

is currently one of the world’s biggest iron ore producers, and has seen

exponential growth in its share price since 2019. Fortescue has continued to

see success throughout the pandemic, with strong iron ore prices and production

pushing the company’s FY20 net profit 49%

higher to $6.6 billion. As a result, the miner increased its dividend, with company

founder Andrew Forrest receiving $1.11 billion in final dividends.

- Resmed (ASX: RMD)

has been on analysts’ radars for a while, with its stock price climbing

significantly over the past few years. The medical equipment company has been

in a good position throughout Covid-19, with investors favouring its stock due

to the company’s role in supplying ventilators and other crucial medical supplies. Despite

posting strong results for Q4 2020, Resmed’s

stock price declined, with some investors concerned about declining demand for

the company’s sleep devices, as well as an expected decrease in ventilator sales as the pandemic subsides.

- Zip Co (ASX: Z1P)

is another BNPL start-up that has seen massive growth recently, and is

currently in a race with main competitor Afterpay to achieve global adoption of

its technology. While the company reported a 61% increase in net bad debts and

losses of $44.9 million in its preliminary FY20 results, much of this can be attributed to its expansion

efforts. Zip also announced a partnership with eBay in August, and made moves to acquire leading US BNPL company Quadpay.

Join over 150,000 global investors and start tracking your investments with Sharesight’s portfolio tracking tool.

This article is sponsored content. The supplier of this content has a commercial arrangement with Switzer Financial Group.