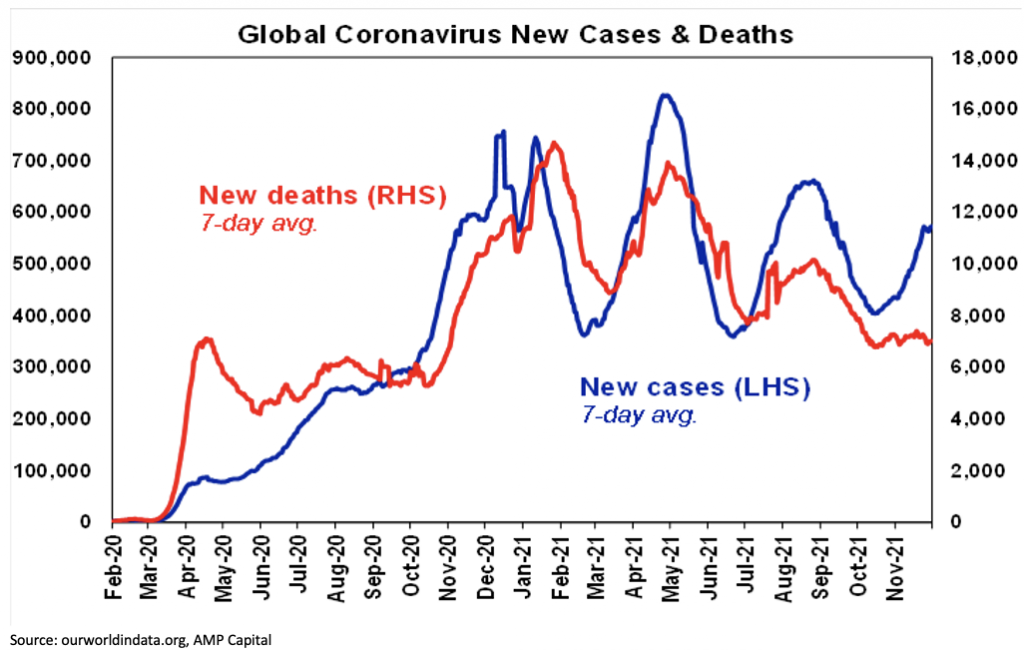

Global coronavirus cases remain in a rising trend but showed some slowing over the last week. Deaths so far remain subdued compared to previous waves. Its’ still very early days in the Omicron wave though.

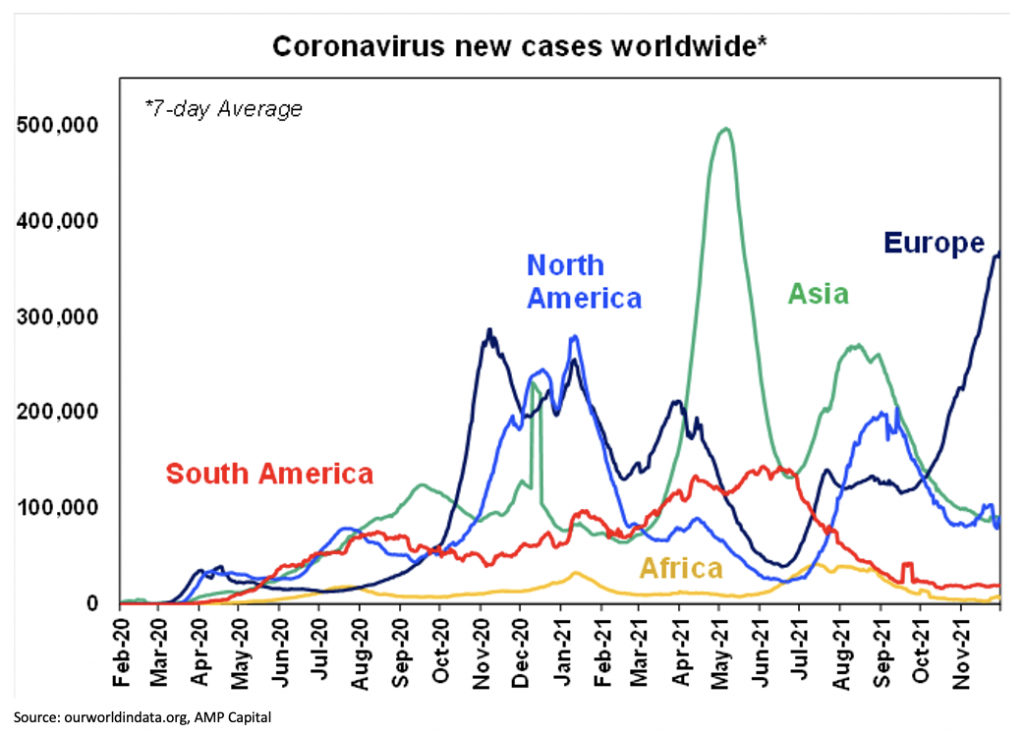

Most of the surge has been driven by Europe – it’s slowed a bit in Germany, Austria and the Netherlands but France, Italy and Spain are picking up. US numbers slowed with reduced testing during Thanksgiving but are trending up with the onset of winter, low vaccination rates and entry of Omicron. Africa is starting to pick up with Omicron but from a low base.

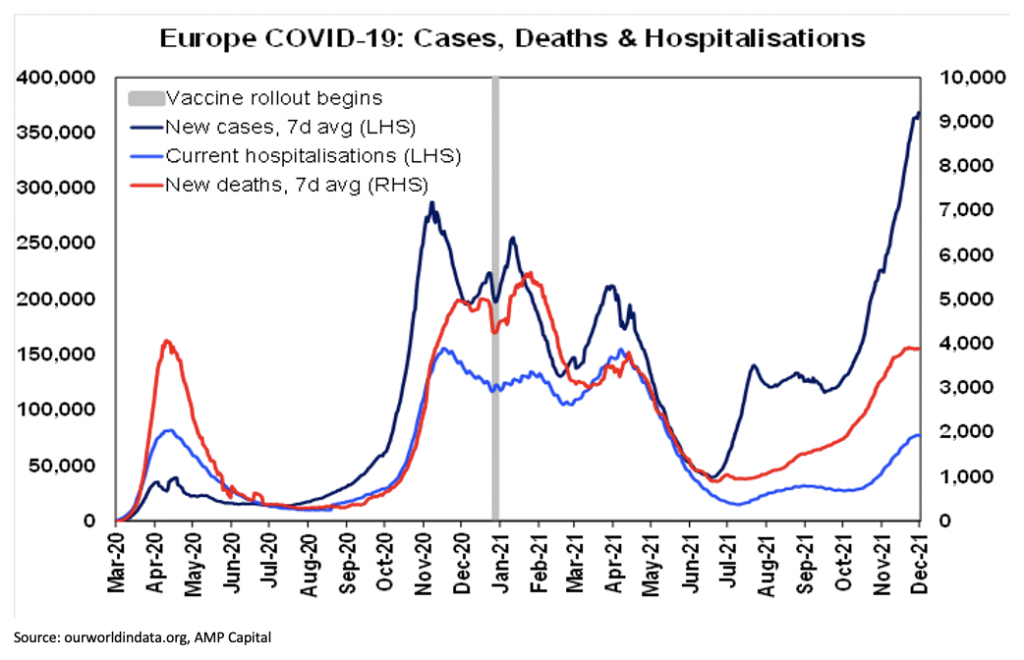

The key to the threat the latest wave poses to the economic outlook remains whether vaccinations are successful in keeping hospitalisations down such that hospital systems can cope without lockdowns.

The level of hospitalisations is also the key issue in relation to the new Omicron variant. So far hospitalisation and death rates in Europe remain subdued relative to the wave a year ago. This is also the case in the UK where hospitalisations and deaths are actually trending down.

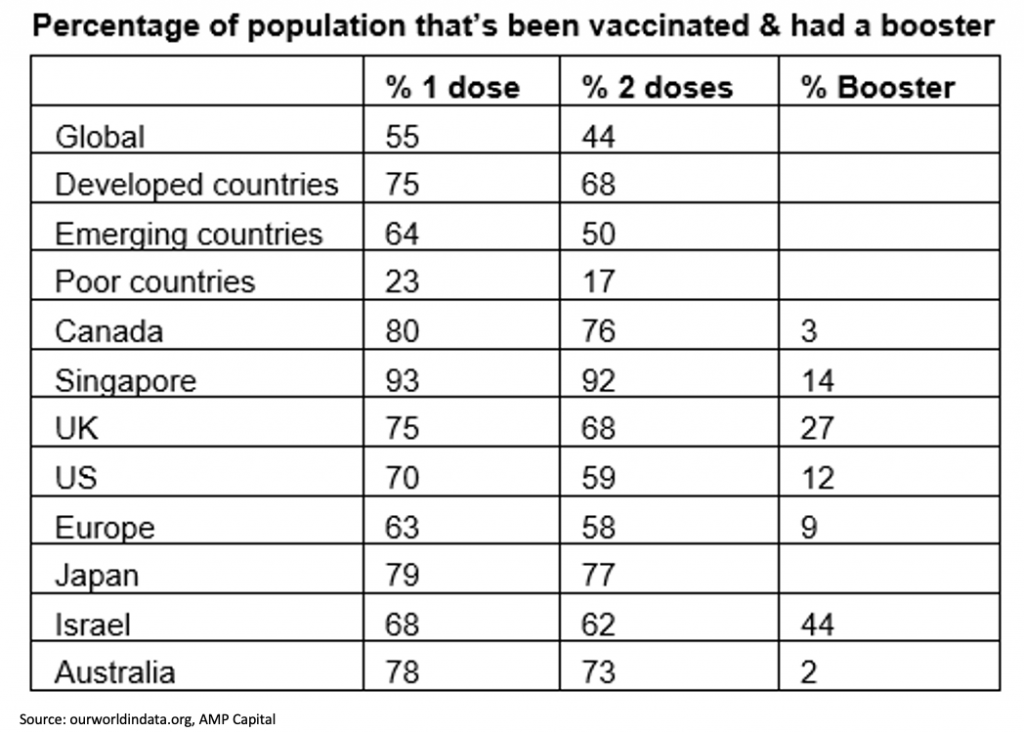

55% of people globally have had one vaccine dose, 75% in developed countries and only 23% in poor countries. While vaccine efficacy against Omicron is not yet known, a key problem beyond that is that vaccination rates in Europe and the US remain low and the very low vaccination rates in poor countries leave open a high risk of further mutations. So it remains in the interest of developed countries to help poor countries vaccinate as quickly as possible. Germany is also joining Austria in moving to make vaccines mandatory.

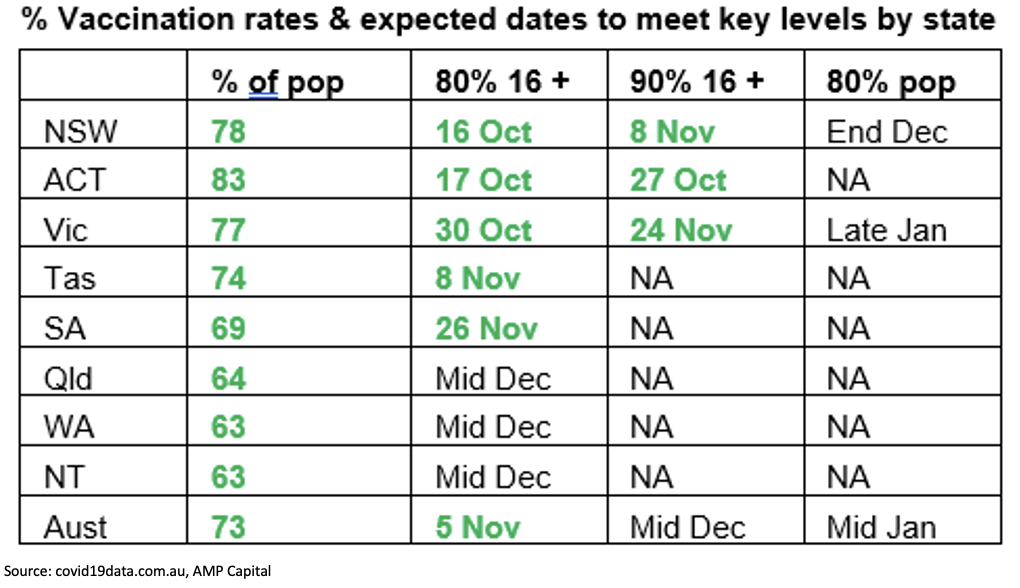

Australia at 78% of the population with first doses and 73% with second doses is at the high end of developed countries. On current trends, Australia will average 80% of the whole population fully vaccinated around mid-January. New coronavirus scares and the likely approval of vaccines for 5 to 11-year-olds should take the percentage of the population fully vaccinated well beyond 80%.

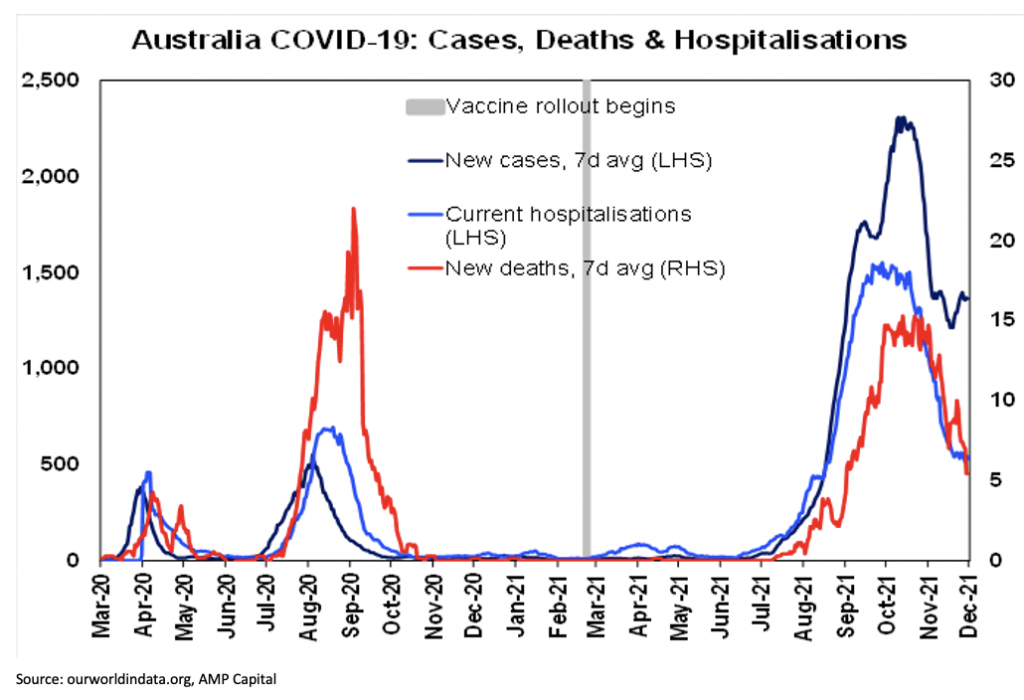

A resurgence in new cases in Australia looks almost inevitable given the experience of other countries and with the likely more transmissible Omicron variant now spreading in Australia. In fact, cases are already starting to trend up again. But the key will be if vaccines help keep hospitalisations subdued such that the hospital system is not overwhelmed. At present new cases are up from their lows but hospitalisations and deaths remain subdued.

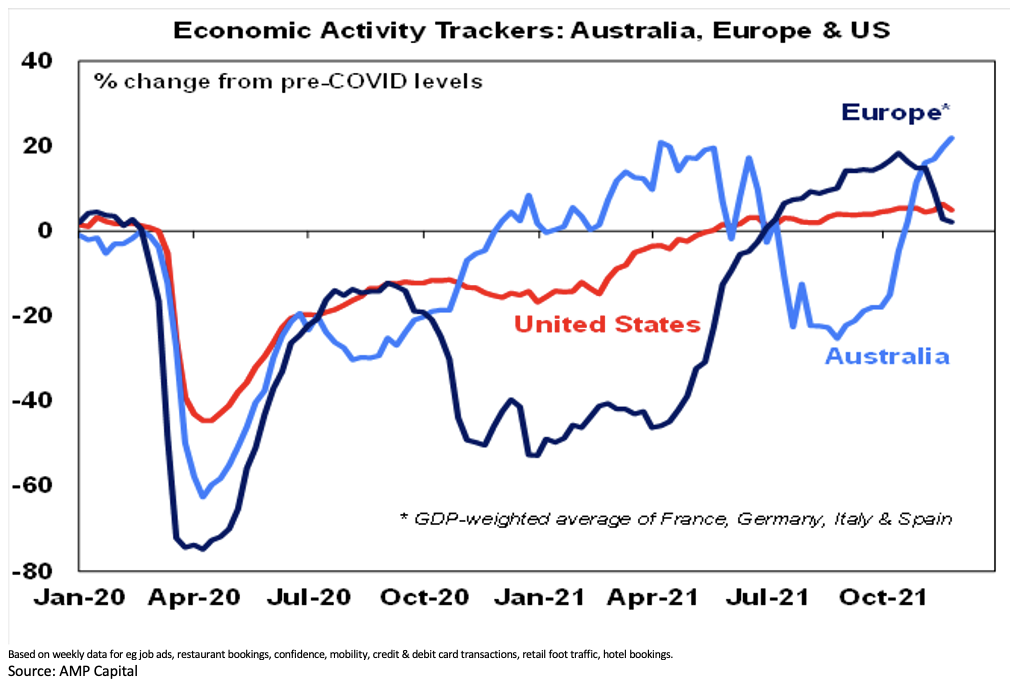

Economic activity trackers

Our Australian Economic Activity Tracker rose again over the last week with broad based gains on the back of reopening and is now just above pre-Delta levels. The rebound in our Economic Activity Tracker reflects a resurgence in mobility, credit and debit card transactions and restaurant and hotel bookings amongst other things and points to points to a very strong rebound in Australian GDP this quarter.

By contrast, our European Economic Activity Tracker fell again in response to rising cases and restrictions in Europe and our US Tracker also fell slightly. Lockdowns or not, fear of Omicron is the main risk going forward.

Australian economic events and implications

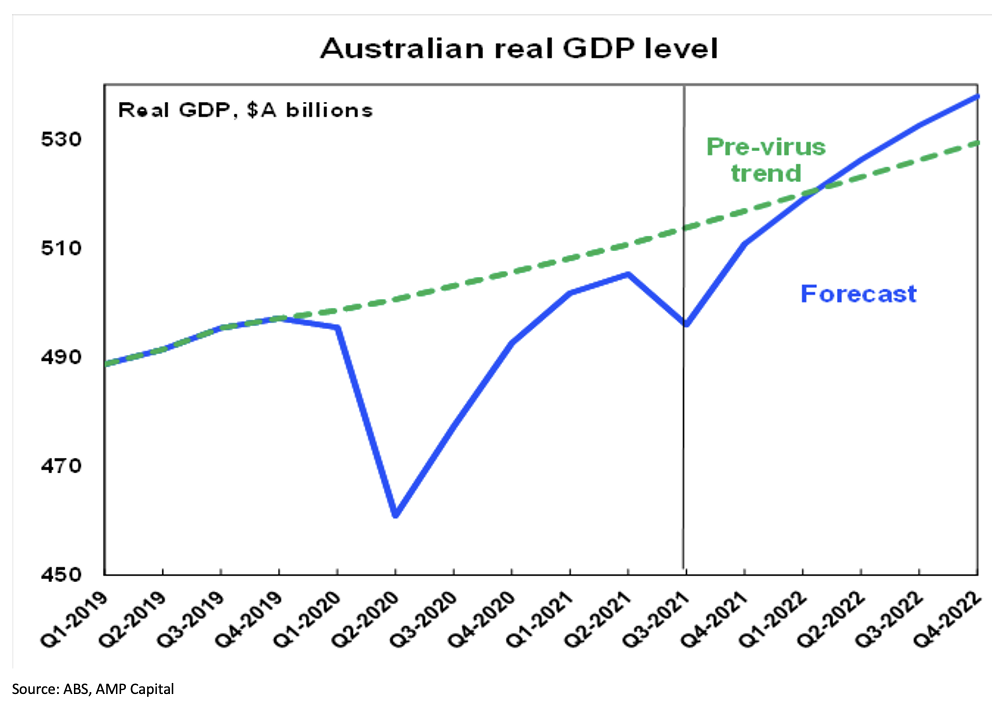

Australia GDP fell less than expected in the September quarter and looks to be recovering rapidly. While September quarter GDP data showed the third-largest quarterly hit to the economy on record it wasn’t as bad as the 4% slump we expected earlier in the lockdowns. While it's painful, consumers and businesses have found better ways to manage through lockdowns resulting in a smaller hit to economic activity and public spending and other states provided an offset to NSW, Victoria and the ACT.

As noted earlier, our weekly Economic Activity Tracker shows that economic activity is now rebounding rapidly. And there is good reason to expect strong growth through next year of about 5.5% YoY: the savings rate has rebounded to 20% and there is now roughly $250bn (or 13% of GDP) in excess savings built up through the pandemic which will spur future consumer spending; business confidence is high and investment plans point to 15-20% growth in business investment; and some pre-election Government spending is likely to add to fiscal stimulus through next year.

This in turn is likely to lead to a tighter jobs market and higher wages growth than the RBA is expecting through next year resulting in the start of rate hikes around November. The main threat would be if Omicron turns out to be more deadly than Delta with vaccines offering little protection resulting in a return to lengthy lockdowns, or people cutting back on their mobility anyway out of fear, until new vaccines come along and are distributed resulting in another year of disrupted growth.

More slowing housing indicators

The housing sector led the recovery but it’s now clearly slowing down with building approvals, new housing finance and housing credit growth slowing in October and national home price growth slowing further in November. While CoreLogic data showed a 22% rise in prices over the last year, the monthly growth rate slowed further 1.3% MoM and as a result of worsening affordability, rising fixed rates, tightening lending standards, rising listings and a rotation in spending back to services we see home price growth slowing to 5% next year ahead of a 5-10% decline in 2023.

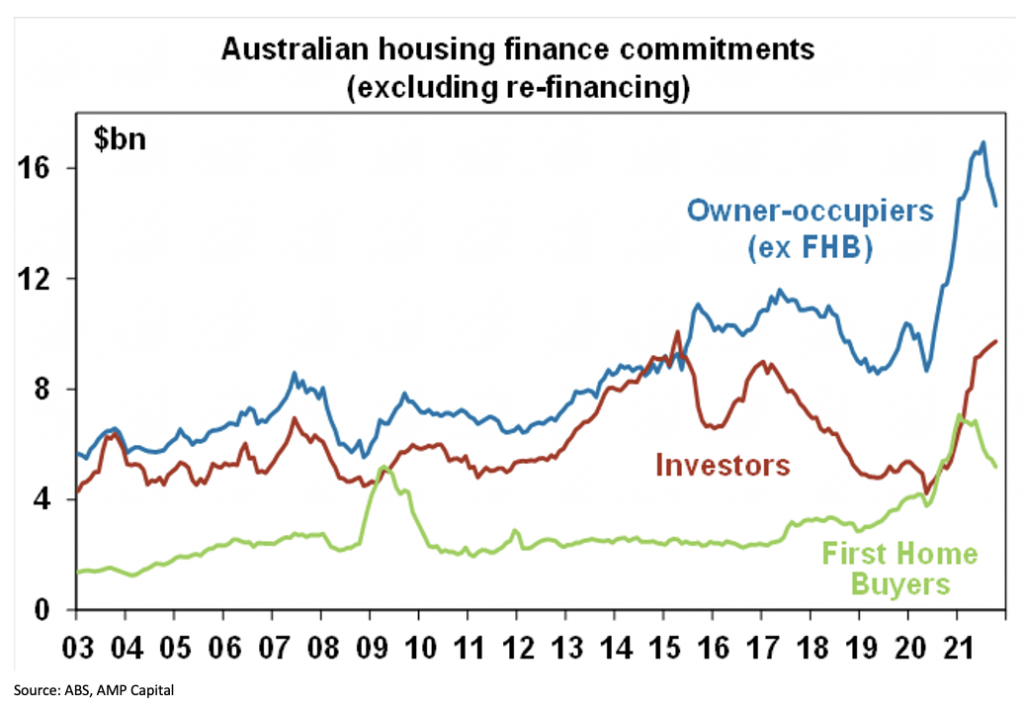

As can be seen in the next chart housing finance going to first home buyers and other owner occupiers is now slowing as more potential buyers are being squeezed out by worsening affordability. Investor finance has pushed up to close to its 2015 high though as investors are less affected by affordability.

The trade surplus fell further in October but remains high at $11.2bn. The value of iron ore exports fell as lower prices impacted, but this was partly offset by coal and gas exports.

What to watch over the next week?

In Australia, the RBA is expected to leave rates on hold and reiterate its dovish guidance on rates. It only removed the 0.1% yield target at its last meeting and since then economic news has been mixed – with stronger than expected September quarter GDP and data showing a strong reopening driven rebound in growth but continuing low wages growth and a new risk to the outlook from the Omicron variant.

So the RBA is likely to simply reiterate its dovish guidance that it will not raise the cash rate until inflation is sustainably within the target range and that this will require the labour market to be tighter and wages growth to be materially higher. While on its “central scenario” the RBA does not see the conditions being met for a rate hike until 2024, our view remains that they will be in place late next year. Market expectations for three or four rate hikes next year by the RBA still look too aggressive though.

On the data front in Australia, payroll jobs data (Thursday) will likely show a further improvement.

Outlook for investment markets

Shares remain vulnerable to further short-term weakness given the rebound in coronavirus cases globally and the new Omicron variant, the inflation scare, less dovish central banks, the US debt ceiling and the slowing Chinese economy. But we are now coming into a stronger period seasonally for shares and the combination of solid global growth and earnings, vaccines hopefully still allowing a more sustained reopening and still-low interest rates augurs well for shares over the next 12 months.

However, continuing inflation and interest rate concerns will likely result in rougher and more constrained gains than what we’ve seen since March last year.