Labor is backing down on worrying aspects of its new industrial relations bill, showing signs that it’s prepared to listen to employers. However, it begs the question: Wouldn’t it have been better to talk to business groups about its bill before it went public with its multi-employer wage bargaining idea?

The answer has to be ‘yes’ and this might be an important first lesson for this new government, if it wants to be more than a once.

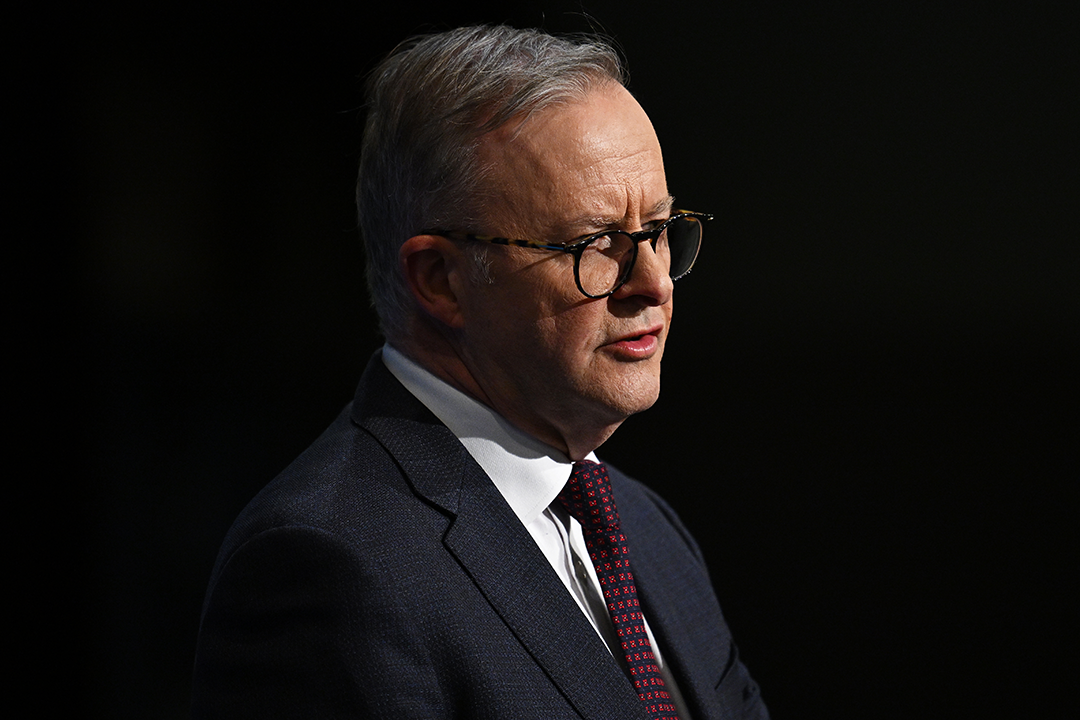

Last Tuesday, Treasurer Jim Chalmers charmed the Business Sydney post-Budget breakfast with his answers to questions until he had to show solidarity with his PM, Anthony Albanese and colleague, Workplace Relations Minister, Tony Burke.

All his other answers were akin to an intelligent national Treasurer keen to get it right for the country, the economy and the people he represented.

On the other hand, his defence of a poorly conceived wage bargaining bill, which could see businesses not doing well paying the same wage rises as those in the fast lane and killing it, which also ignores the relative productivity of workers, was old world, union-inspired thinking.

It was the only time Mr Chalmers would have had many CEOs, employers and managers in the room saying “O-oh!”

But today The Australian reports after a backlash from bosses, a watering down of the new IR bill is expected in the following ways:

1. The new law will now require a majority vote in each workplace before industrial action or multi-employer bargaining agreements could proceed.

2. The government was also looking to implement a six-month grace period before employers were roped into multi-employer bargaining by unions.

3. There could be broader exemptions for medium-sized businesses.

The National Farmers Association isn’t impressed with the Bill and the proposed changes, and The Australian says “Australian Chamber of Commerce and Industry chief executive Andrew McKellar and Business Council of Australia chief executive Jennifer Westacott also rejected the fresh concessions flagged by Mr Burke.”

Business groups fear that multi-employer bargaining will lead to strikes, wage rises unlinked to productivity and higher prices, which will feed into inflation.

Meanwhile, the Bill requires Senate support from the Greens and independents, with former Wallaby and ACT senator David Pocock not prepared to support the Bill in its current form. He says he doesn’t want to stop low-paid workers from getting their pay rise and wants the Bill split in two. “This industrial relations legislation has been very rushed. It’s a massive omnibus bill that is seeking to do a lot,” Pocock told The Australian. “The Senate is there to ensure that bills are adequately scrutinised and that is my primary concern with this bill – the lack of time for scrutiny and consultation.”

ACTU Secretary Sally McManus doesn’t want the changes but concedes that even with them it would “still give millions of workers significantly expanded power to win wage rises”.

Curiously, former PM Paul Keating appears quiet on the subject, as it was he and former union boss Bill Kelty who linked wage rises to bargaining at the workplace level and also linked those rises to the productivity of the business and the employees.

Many believe their efforts in part explain why Australia went over 30 years without a recession, which was a world record for modern economies.

Before the election, at another Business Sydney event, a would-be PM Anthony Albanese painted a picture of a future Labor government, where he paralleled it with the days of Bob Hawke and Paul Keating. In fact, Mr Keating was at the event. But this IR Bill is more like old Labor rather than the new Labor Hawke and Keating pioneered in the 1980s.

Chalmers is new Labor, while Burke is old Labor, but we’re not sure about Albo. Only time will tell and it will show in the economy, the stock market and in our super fund returns.