This is going to be a great news story about the Coronavirus but before I reveal what is getting my hopes up, let me set the scene, in case you’ve been horrified and preoccupied with the bad human and economic news we confront daily. I’ll do this because my news is still speculative but it comes from high quality sources, so bear with me.

There are few things more scary than watching any news service as we learn about the rising infection and death rates worldwide. However, Sky News and hopefully others this morning ran the story that the rate of infections is showing early signs of slowing!

This contrasts with Spain and the UK where the death rates are still rising and the former is starting to look like a challenger to Italy as the worst-affected country in Europe. And you couldn’t help but fear the consequences of India’s surprise lockdown, which has left millions of city-based rural workers who have been forced to head home with no public transport capable of dealing with the travel demands.

The Indian Government has hired thousands of buses to fix the problem but the throngs of crowds don’t have social distancing on their mind, as they push together hoping to board a bus or get some food. In a new Coronavirus world, the news TV coverage of India right now looks like madness ahead of a huge surge in infections and deaths.

I hope I’m wrong as I wanted this story today to focus on good or better Coronavirus news for three reasons.

First, I want to be able to help positivity by reporting the stuff that gets ignored by news services chasing the bad, albeit relevant COVID-19 stories.

Second, good news is actually news and it takes a real tragedy like this to make more and more of us pray that the news will actually bring something to feed our hopes.

And third, we need good and improving virus data news to lift the confidence in the economy and the stock market. The more people we can keep in jobs earning money and the less we can restrict the down legs for the stock market, the quicker that recalculations will be made by professional market players and investors, so that the prevailing fear-driven stock prices are replaced by more realistic ones.

What I’m really talking about is better virus data, earlier than expected, which will not only stop the stock market dropping say to down 40% or 50% before it rebounds, but bring forward the rebound in the stock market in terms of time. History says our stock market rebounds 30% to 80% in the year after a crash and that is linked to two important developments.

First, the calibre of the Government and Reserve Bank’s policies response. And second, the length and the depth of the recession that this crash and the Coronavirus containment policies are undoubtedly creating.

I hate seeing news items talking about “the largest death increases” and you have to hope that’s these big increases get us closer to the peak and what the experts talk about, namely the flattening of the curve.

In this respect we are getting some good news.

Our Chief Medical Officer, Professor Brendan Murphy fronted a press conference and said the rates of infection are slowing. And while it is early days, it was worth recognising. This was delivered as we saw playgrounds were closed and public groups bigger than two were banned. The Government is trying to put its foot onto the neck of this damn virus and how the public deals with it and the tough stuff now looks like a stitch in time that might save nine but, more importantly, saves more lives and gets us back to normal ASAP!

And on that subject, Chris Joye, the founder of Coolabah Capital Investments and his money market research team, who now have become full-time infection rate watchers worldwide, have made two bold calls on the peaking of the virus and the eventual flattening and then dropping of the infection and death curves! This is what he was saying yesterday: “Australia's peak new infection numbers are realised between April 4 and April 11 assuming it is 50% as effective at containment as South Korea and 75% as effective as Italy (see second screenshot). If Australia is only half as good as Italy at containment, the peak in new infections is observed around April 20. Interestingly, Australia's infection rate and, in particular, its fatality rate are tracking better than North Atlantic nations with Australia's fatality rate sitting somewhere between South Korea and Japan.

Meanwhile the news for the USA is better than what current numbers could be making us feel: “The peak in America's new infection numbers will be realised between April 9 and April 18 assuming it is 50% as effective at containment as South Korea and 75% as effective as Italy. In a more gloomy scenario where the US is only half as effective at containment as Italy, the peak new infection numbers materialise around April 29. For the time being, America's fatality rate is growing at a slower pace than the UK, the major European nations, and China's original path.

Chris also makes the point that Microsoft’s Bill Gates is also predicting the US infection peak will be around late April, which coincides with the Joye numbers.

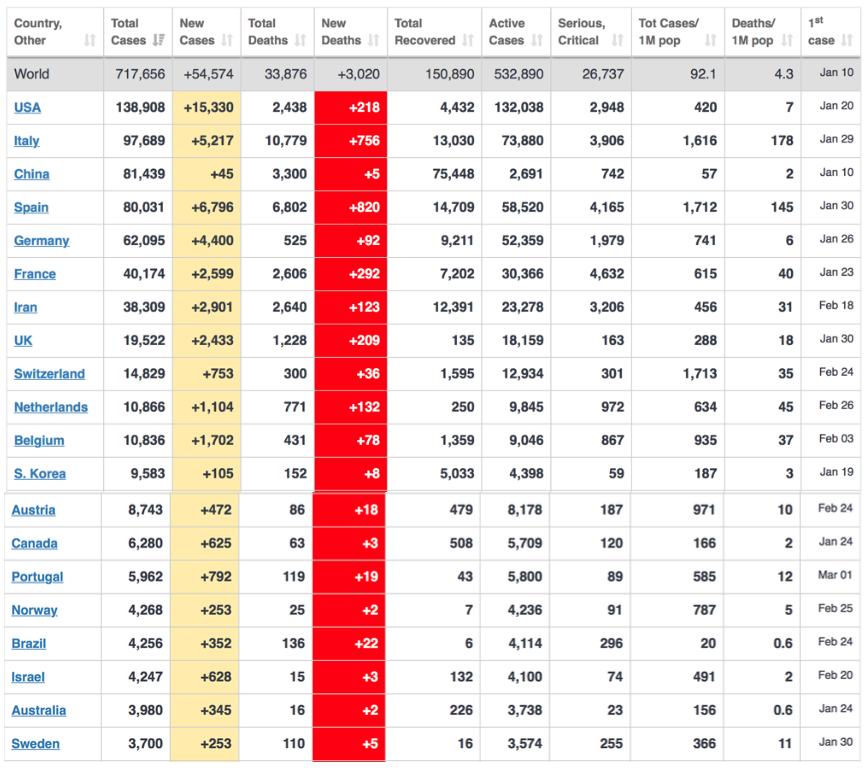

And check out how we’re doing against so many countries worldwide:

Our deaths per 1 million people are at 0.6, while Sweden is 11, Netherlands 45, Switzerland 35, UK 18, USA 7, France 40, Spain 145 and Italy 178. For all the reasons, including the Government’s response, we should be grateful for what has happened so far, despite the tragedy of who we have lost so far. Our total deaths are 16, which is astounding!

And so Chris Joye’s predictions mean so much more if they turn out to be on the money. Let’s pray that they are!

And finally, let me list the new initiatives that are coming out of Canberra, which will be a part of stimulus package Mk III, which is expected to be the biggest one yet:

• A wage subsidy is coming to keep people in work up to $1,500 per employee a fortnight.

• Banks will extend the deferring of business loan repayments to six months for loans up to $10 million. This is up from $3 million and helps 30,000 businesses.

• Commercial and residential landlords will be stopped from evicting tenants in trouble because of the Coronavirus containment policies for the next six months. The business loan repayment deferments are expected to be offered to property investors who need the rent from their tenants to meet their repayments. • All foreign investments into Australian businesses will be checked by the Foreign Investment Review Board. The starting point of a review is to start at zero dollars and it could take six months to make a decision! This was sparked by “at least two cases of Chinese-owned companies in Australia securing tonnes of precious medical supplies and shipping them back to China,” the AFR reported today.