The combination of inflation and what someone thinks represents a comfortable retirement nowadays has spiked by $50,000. And it will keep rising. So, what should pre-retirees do to avoid a poverty trap once they leave work for good? Answer: become savvy about investing! More on that later.

Thanks to the lockdowns and then the inflation surge, the supply chain problems and the lack of foreign workers that all followed, and throw in Putin’s war hit on oil prices, retirees need more money in retirement.

The Association of Superannuation Funds of Australia (ASFA) does an annual calculation to work out what someone needs to retire comfortably, using their own super money and the Government pension. On current calculations, a single person needs $595,000 in super, while a couple needs $690,000.

The Daily Telegraph tells us that ASFA has cranked both figures up by $50,000 to arrive at those numbers because of inflation and the new cost of living that prevails in Australia now.

This table shows you how ASFA arrived at the cost of a comfortable life, if you leave work right now.

The Telegraph talked to ASFA chief executive Martin Fahy, who said retirees usually spend a greater proportion of their income on staples. The research shows these costs have climbed the sharpest. “Food’s up by 9.2 per cent, bread’s up 13.4, anything to do with imported oils and fats 20 per cent, electricity is up by 12, and travel if you are doing it is up by 20 per cent,” he said. “In the face of inflation, we need to be saving for retirement.”

Right now, 1.8 million Australians get the Age Pension, while 782,000 get a part pension, but they have to pass an assets or income test to qualify.

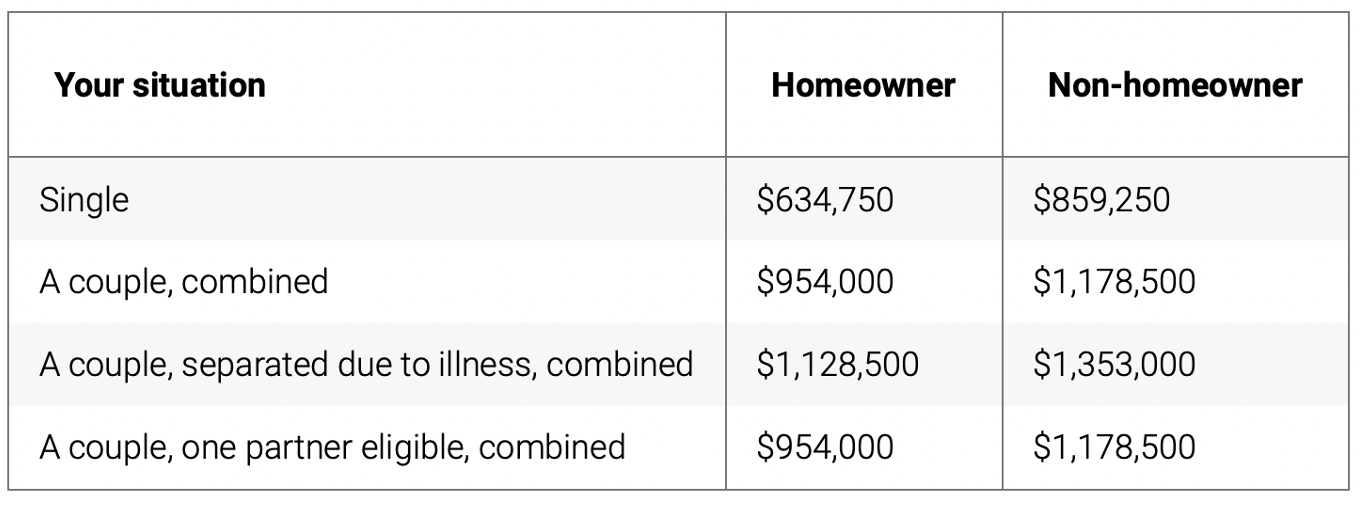

If your super and other assets are more than the limits below, you don’t get the full pension.

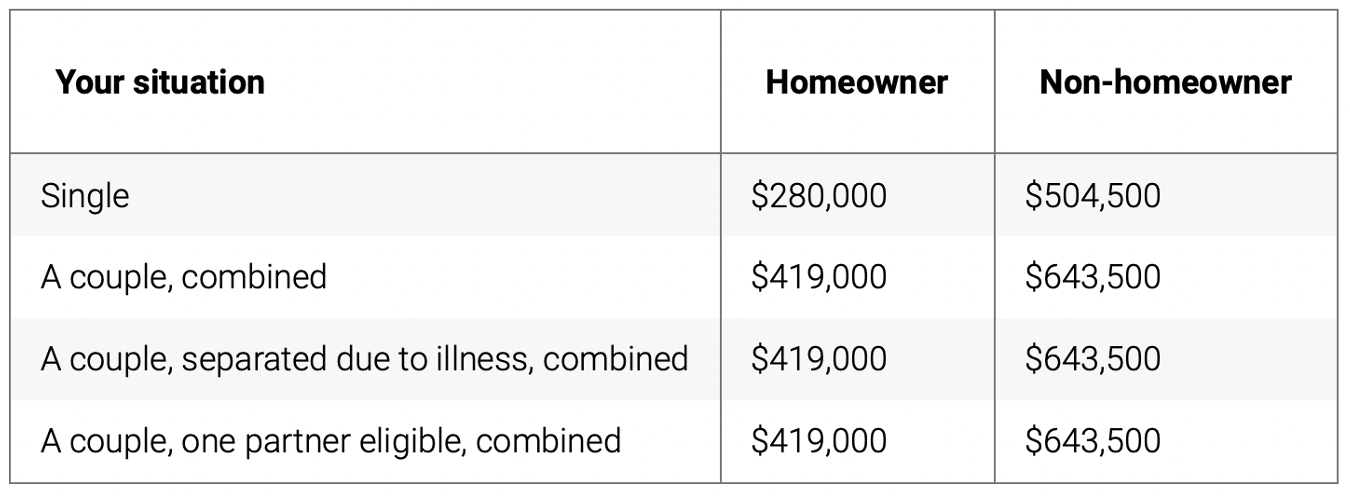

And if your non-home assets exceed these limits, you don’t get a part pension.

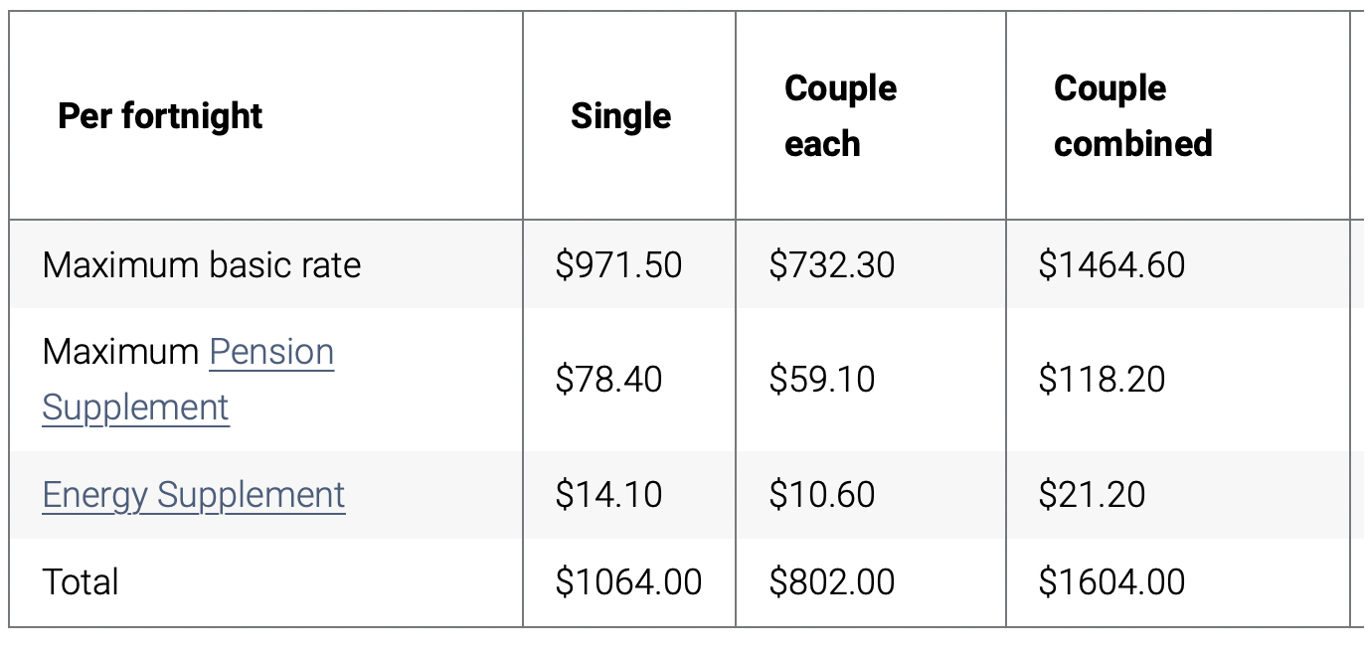

From 20 March 2023, the maximum full Age Pension increases $37.50 a fortnight for a single person, and $28.20 a person each fortnight for a couple.

And this is what you can get on the pension:

Taking a couple, the most they’ll get is $802 a fortnight each. Any other money they want to spend will have to come from personal savings or from working part-time. But that can eat into your pension, so a full pension becomes a part pension.

There’s no way out. If you’re young or a pre-retiree, you have to become savvy about investing and that means you have to save or earn money and then invest it to make sure your super balance will give you a decent life in retirement.

Here's my short-list of actions you need to take to get wealthy enough to avoid the pension:

Remember: “Anything worth doing is worth doing for money.”