Bitcoin frenzy is on the rise again! Undoubtedly, I’ll get asked if it’s worth investing in bitcoin. Like I did five years ago and one year ago, I’ll reply that if I can’t understand it, I won’t invest in it.

I don’t understand the many drivers of bitcoin’s price so it’s in a ‘no go’ zone for me. I say the same for gold. One reason I don’t invest in gold is that the advocates of gold say it’s a store of value, but its value changes and it doesn’t pay income.

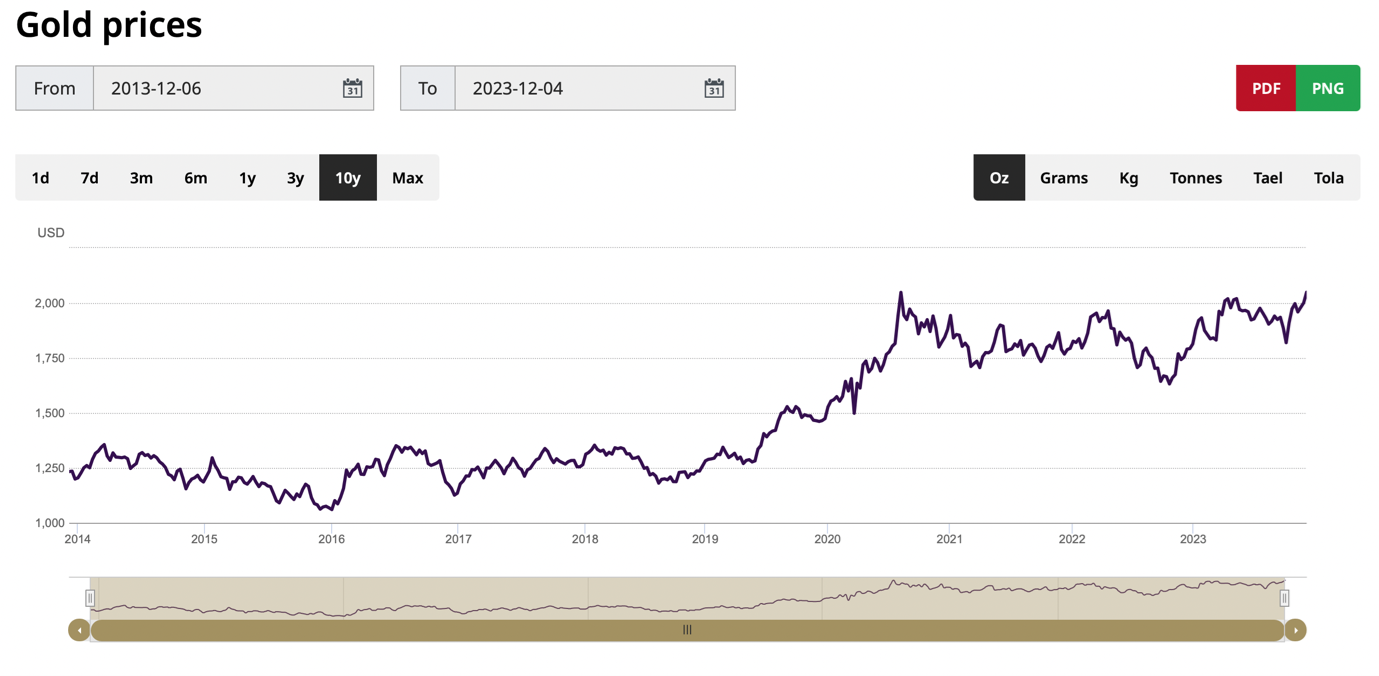

That’s not to say you can’t make money out of gold. If you bought gold between 2014 and 2019, the price range was US$1,068 an ounce to US$1,350. You could have gains of 25% but equally you could have lost 17% depending on what you bought in. However, given its current price of US$2,049, you could have made around 90% at the most and 50% at the least over 7 years, which are returns of 13% a year or 7%.

It kind of makes gold look like an OK capital gain gamble, if you buy at low levels. But you have to be careful about going in now.

By the way, if you bought gold in the 1970s, you would’ve done pretty well, as the chart below shows. But if you bought in February 1980 at US$696 an ounce, it took until September 2007 for you to be out of the red!

That’s 17 years of ‘hating’ the stuff!

If you were a patient ‘hater’, you’d now be a gold fan. But if you sold before September 2007, you’d now ‘hate’ gold more and even yourself for giving up 27 years of misery!

Is this what you want to invest in?

I can see a small role for gold in a client’s portfolio, but I always want to buy it at relatively low prices.

Interestingly, gold and bitcoin tend to move in the same direction, but it does this only sometimes. Bitcoin was smashed with the tech sell-off in 2022 as interest rates were quickly hiked by central banks. And like some tech stocks, since there has been talk that US rate rises are over, bitcoin’s price has made a comeback.

Bitcoin

Bitcoin peaked in November 2021 at US$64,400 and fell to US$16,683. Now it has spiked to $43,452. The simple lesson is that if you want to buy gold or bitcoin, the best time is when panic sets in, but both commodities are big gambles.

Do I think bitcoin will go higher from here? Yep, especially with talk of falling interest rates, as well as a falling US dollar, both of which favour bitcoin and gold. Also, there’s the possibility of an exchange-traded fund for bitcoin, which will attract demand, and this should help the price of digital ‘currency’.

The pluses for bitcoin are also that there’s an army of digital supporters who are believers and users of bitcoin, from tech nerds to criminals and smart alec fund managers, who all could be regular buyers.

The AFR’s James Thomson has looked at the latest hype around bitcoin. Here are some of his key observations:

1. Bitcoin over US$42,000 means this cryptocurrency is up 55% since mid-October.

2. Some bitcoin believers say it’s a safe hedge against inflation but the recent collapse of its price in 2022 with high inflation and interest rates counters that argument.

3. Some fund managers see that a 2% to 6.5% holding of bitcoin could make sense. I’d say that was a better idea when bitcoin was around $17,000.

4. Bitcoin’s supply increase is really small, which helps its valuation, but no normal person gets how bitcoin is created.

5. Even though inflation is falling, interest rate cuts won’t be any time soon. And there won’t be enormous cuts, with most economists saying that while rates will be lower eventually, they’ll be relatively high for a sustained period of time.

The bottom line? Bitcoin is a gamble. I won’t be surprised to see it go higher, as rate rise talk and rate cut speculation increases, but it’s a punt not an investment. And it’s not the best money play for anyone with insomnia!