Reading the economic tea leaves and notes from John Kehoe, influential economics editor of the AFR, makes me think a May rate cut is a near past-the-post certainty. Only a bad CPI reading on April 30 could ruin this great news story.

Who can we thank for this good news? Try Donald Trump and his less-than-likeable tariffs!

Today Kehoe surveys prominent economists and are the main points from the story:

What’s more likely? That will depend on how worried other economies, economists and fund managers are about the Trump tariffs. The view that emerges after hearing about Trump’s negotiations with China first and then Canada, Mexico, the EU, Japan and South Korea will be absorbed by Wall Street. This will then affect global stock markets and ultimately business and consumer confidence, which then will determine what happens to interest rates.

The scarier and crazier that the Trump tariff stories are, the more fear will be generated about the global and individual economies, and rates will fall as a consequence.

In the short term, stocks would slump with crazy tariffs or spike on sensible negotiations and outcomes.

Ultimately, like many things nowadays, we’re in the hands of the President of the USA. Personally, I’d prefer sensible negotiations that would lead to a progressive improvement in stock prices, market indexes and our superannuation balances.

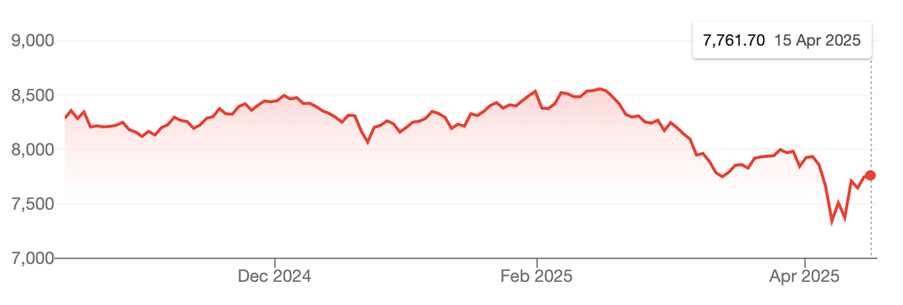

This chart shows how we’ve lost 9.2% off our stock market since February 14, when Trump tariff concerns started to escalate.

S&P/ASX 200 Index

The little kick up on the right of this graph shows the impact of Trump U-turning and granting sensible exemptions. It shows what could happen if what we see in coming weeks and months is seen by markets as being sensible and reasonable.

This is a big test for Trump. As a business negotiator, he could play any game he liked. However, as President of the world’s richest and most important economy, stock market and bond market, he has a responsibility to be not so ‘mad’ crazy.

Last week, the bond market taught him a lesson about being a President who shoots from the hip. Let’s hope he keeps those guns in their holsters going forward. If he does, he could be seen as the guy who helped interest rates fall and stock prices rise.