Dr Phil Lowe has cast the dye with this 11th interest rate rise since May last year. He will either be known as a monetary policy genius or an economic nincompoop! I hope he ends up being a genius for all of our sakes, but he has taken a huge punt.

Don’t think all of Australia dislikes him because savers will love the higher term deposits that will result, but those with loans will despise him. That goes double for anyone who’ll soon roll off a low fixed rate loan onto an even higher variable rate loan because of Tuesday’s decision. These borrowers would love to have Dr Phil’s guts for garters!

What adds to the drama of this rise is the fact that the money market was betting 100% that there would be no change. Also, the majority of economists agreed! And this surprise action comes as Dr Phil looks a good chance to lose his job in September, when his contract is up for renewal. Meanwhile his partners in crime — his board — has already been earmarked by Treasurer Jim Chalmers to be replaced by a new and ‘better’ team in the near future.

So, with that background, how come Dr Phil shocked us with this 0.25% cash rate rise, taking the official rate to 3.85%?

The AFR’s John Kehoe listed the four reasons for Dr Phil’s punt on another rate rise:

Given those four reasons, you can see why Dr Phil is taking a punt on another rate rise but I think he’s ignoring the following:

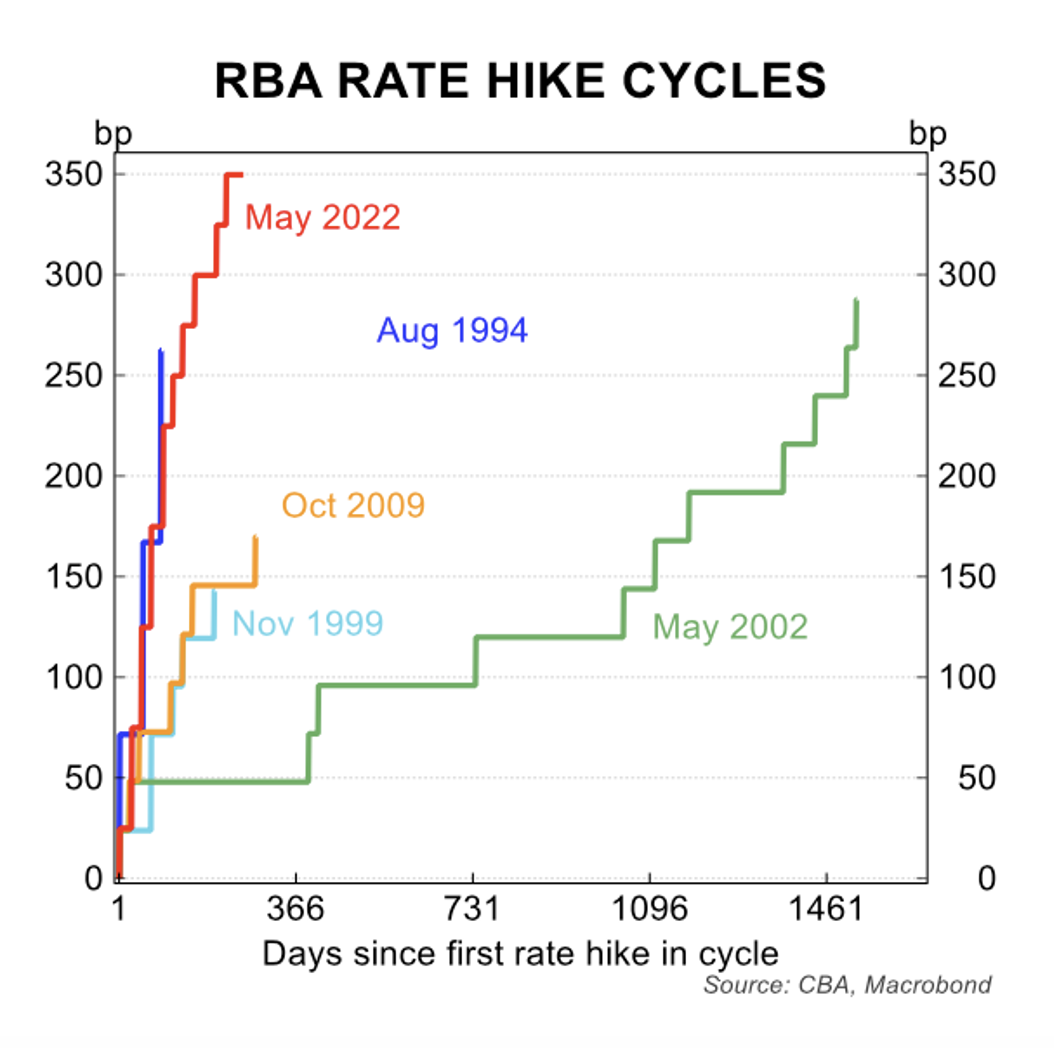

I could accept the previous 10 rate rises until I saw this chart from CommSec.

This is the steepest and most emphatic tightening of interest rates ever. If it proves to be too aggressive, it could throw us into recession!

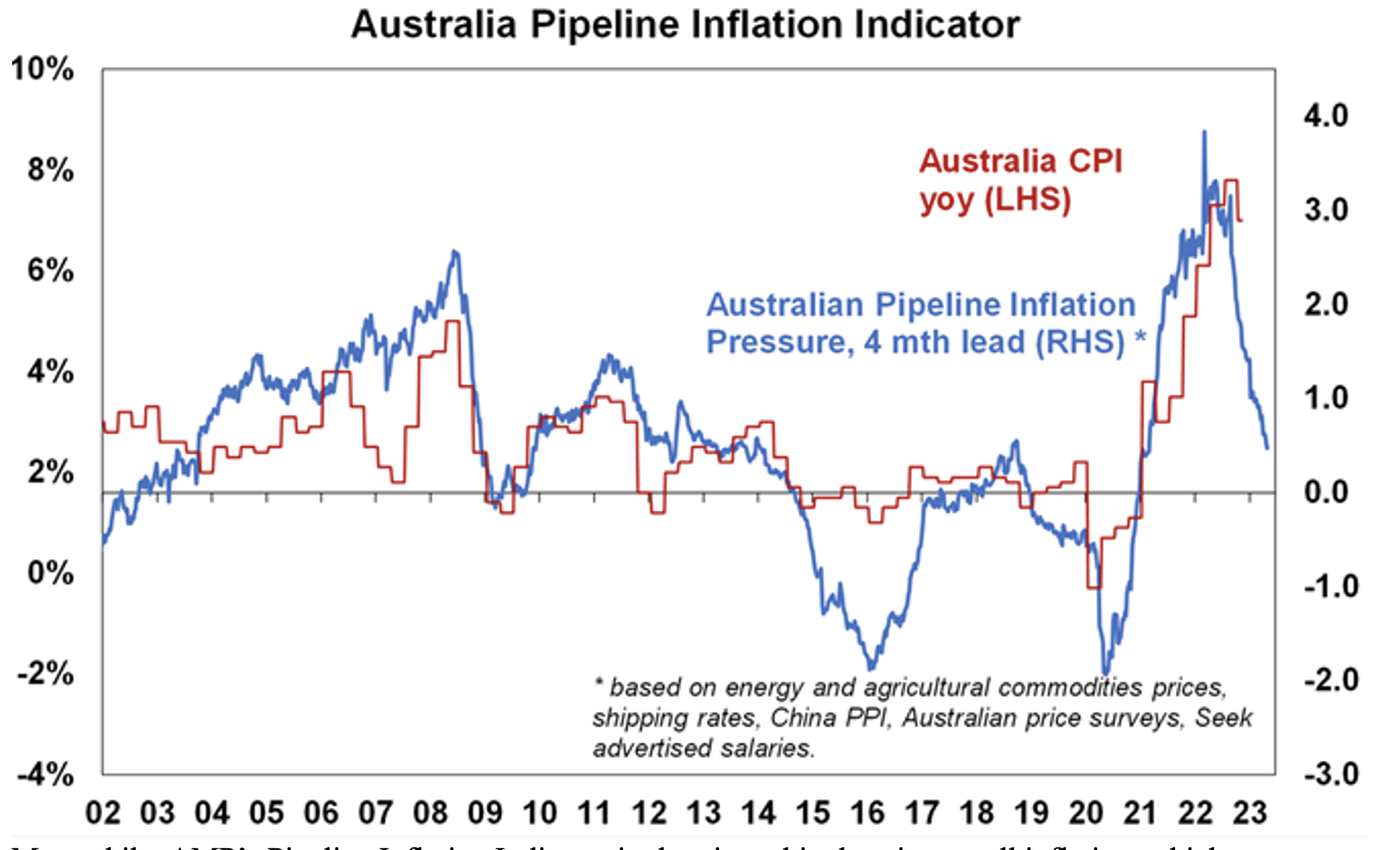

Meanwhile, AMP’s Pipeline Inflation Indicator is showing a big drop in overall inflation, which, in terms of time, is a long way in front of the official CPI.

That said, goods inflation is really tumbling but services inflation is far more stubbornly high, but I bet the mortgage cliff will affect our demand for massages, holidays, restaurants and other services as 2023 progresses. This should make services inflation fall.

I hope Dr Phil is right and he beats down inflation without a recession, which will mean he could cut interest rates by year’s end or early next year.

If he’s wrong and his excessive rate rises push us into a recession, then rates will be cut earlier to rescue jobs and businesses. The people involved in this recession will be victims of too many rate rises from someone who’ll be remembered not as a genius, but a nincompoop.

I hope he ends up a genius for the sake of Aussie employees and their employers’ businesses.