What I’m going to share with you could and should make you rich but you’ll have to save, wait and invest. Let me run that past you again — you have to save, wait and invest.

Can you do that?

I reckon it’s doable for everyone but for each person who thinks about this being a good idea (i.e being richer), there’ll be many who just won’t commit to the plan that I’ll outline for you.

The website justaustralia.com.au says the average salary is $1,500 a week, so your tax would be $371 and you’d clear $1,129. And if you GST’d your life by siphoning off 10% of your after-tax earnings a week, you’d save around $110 a week or $5,720 a year.

That’s the saving bit. Now comes the waiting game. Let’s assume you’re not invested in the stock market except via your super fund. That means getting in now could leave you exposed to a market crash over the next one, two or three years. So why risk it?

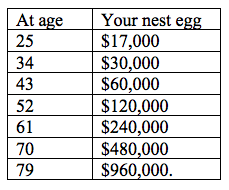

If you wait and the crash doesn’t come for three years, you’d then have around $17,000 ready to put into the stock market.

After the crash and when it looks like the worst is over, you could then invest your $17,000 into say iShares exchange traded fund for the Australian S&P/ASX 200 Index, with the ticker code IOZ. And if history can be trusted, you should make about 10% per annum over a decade, even with some shockingly scary years! How come? Well, over 10 years you’ll get seven to eight positive years that trump the bad ones.

That’s a nice use of the word “trump”.

Now let’s look at what happens to your $17,000 if you just let it ride in IOZ.

If your money is attracting a 10% return per annum, your money doubles every 7.2 years, but let’s call it 7 years.

Assume you’re 25 years of age in 2023 when the crash is over. At age 32 your $17,000 has become $34,000. By 39, it’s $68,000 and 46 it’s $136,000. Creeping to age 53 it’s now $272,000. And age 60 that $17,000 has become $544,000 and by a decent retirement age, it’s $1,088,000!

Yep, I ‘ve turned you into a millionaire by saving $17,000.

But wait, there’s tax. Let’s assume you’re taxed 30% over that time, which is a big slug.

Rather than getting 10% per annum, you’d be getting 7.7%. This means your money doubles every nine years, rather than every seven years. So this is how your money would grow.

The tax slug reduces your richness but you can offset that by doing an investment play inside super, which is taxed at only 15%. Or you could start off by saving more.

If you saved $30,000 at the 30% tax rate, with your money doubling every 9 years, you’d be close to $1 million by age 70!

The secret is all about getting a nice sum of money saved, waiting for the right time to join the stock market, then investing in the top 200 companies in Australia. And watch your money grow.

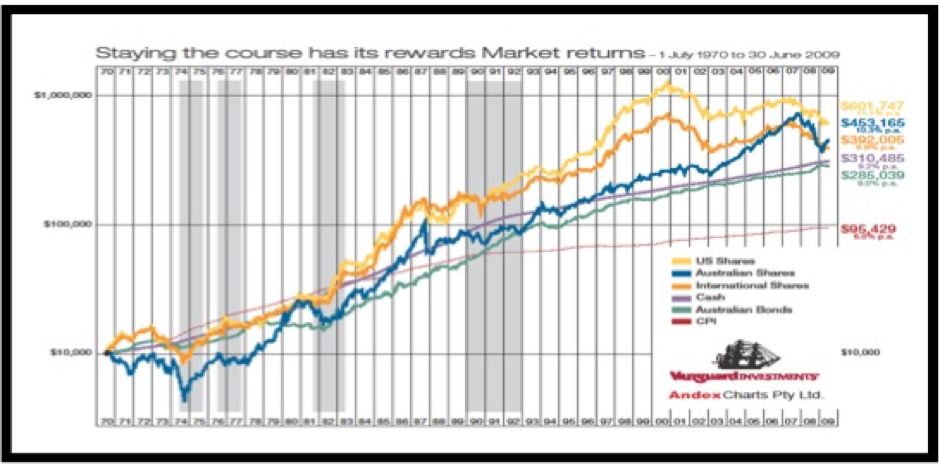

This chart proves my point.

The blue line shows how $10,000 invested in 1970 grew into $453,000 by 2009 — one year after the GFC! Despite six big stock market slumps, $10,000 became $453,000 in Australia. In the USA, the yellow line shows it grew into $601,747!

So what do you have to do to get rich over time?

You have to save, wait and invest. You should learn about exchange traded funds, lowering your tax rate legally and how to get your money into investment products like IOZ!

And if you are wondering why, remember, anything worth doing is worth doing for money!

I’ve explained this briefly here but without sounding too promotional, my new book Join the Rich Club has been published. You’ll find a whole lot of smart money information in it, even if I do say so myself!