Brad Banducci, the outgoing boss of Woolworths (WOW) was threatened with a spell in gaol by grandstanding Greens Senator Nick McKim, which was way over the top, given he could easily have been more insulting towards Banducci for being allegedly deceptive over his company’s profitability and its screwing of its customers.

The battle between the two men was in a Senate hearing into the big supermarkets and it was over a measure used for assessing a company.

Senator McKim said WOW’s return on equity was 26%, which was on par with the big miners like BHP and Rio but half that of the banks.

The AFR team watching the battle made the point that “…the retailers, like the big miners, argue that other metrics such as return on capital [note: which means return on investment or ROI] are a better indicator of how profitable the business is”.

So, on one hand, big profit-makers like ROI (return on investment) but the Senator and I have to say investors often look for a company with a big return on equity (ROE). ROE compares the profits to the value of shares of a company.

An objective source such as Investopedia says a number between 15% and 20% is the type of company we should look for.

That means WOW with 26% isn’t letting down its shareholders, which of course would include the country’s big super funds and the million or so Aussies with self-managed super funds (SMSFs). That said, since the Government and the Greens have been looking at smacking the supermarkets for over-charging and helping inflation stay high, the share prices of WOW and Coles (COL) have tumbled. Not helping has been the Greens talking about breaking up the companies!

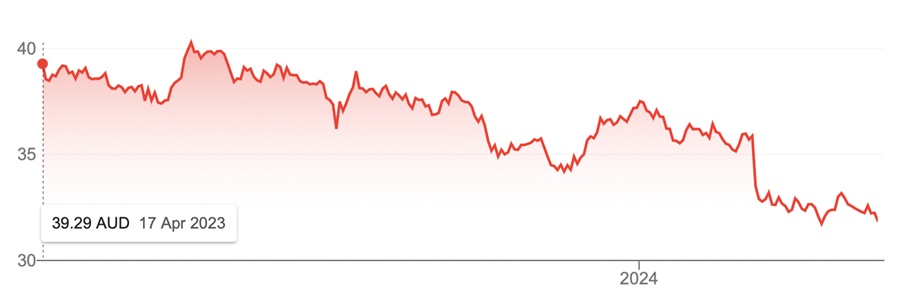

Have a look at WOW’s share price fall over the past year:

Woolworths (WOW) one year

That’s an 18.8% slump!

After a lot of arguing, Banducci admitted to not knowing WOW’s return on equity (ROE), saying his company focuses on return on investment (ROI). It was around this lack of information from Banducci that had Senator McKim talking about gaol time for the supermarket boss.

By the way, ROI is also used by businesses to measure the success of their investments and to identify areas where they can improve their returns.

The AFR says his rival Coles CEO Leah Weckert had no trouble with her figures. She “…came out quickly revealing that the company made just over $1 billion net profit last financial year and achieved 31 per cent return on equity. Coles had a 15 per cent return on capital last year, noting the metric is used for executive remuneration.”

These are impressive numbers. You can see how the ROI is less than the ROE, which is why the supermarkets and miners focus on the lower number.

The bottom line is that both supermarkets are very good companies for shareholders, or at least until they went under the political microscope because of the cost of living spike after the pandemic. And that pandemic, being so weird and out of character might have justified governments introducing prices surveillance regulation to prevent the price gouging that went on with many businesses, not just supermarkets.

This would be over-the-top ordinarily but after the pandemic, these were special circumstances where an active government body might have contained inflation by putting pressure on big price-makers to show restraint.

That could be a way to check the checkout exploitation by supermarkets but the area where the big retailers take their pound of flesh is with small suppliers. Their behaviour is sometime ruthless. It can be akin to that of a mafia boss who has the power to make or break a supplier. On one hand, the supplier gets excited to be accepted by the big supermarkets but is then screwed on price and other demands, which makes the experience and relationship a nightmare.

Who can forget how terribly the dairy farmers were treated by the big supermarkets? This from the AFR in 2019 reminded me of what the dairy farmers copped: “Coles and Aldi have followed Woolworths in raising the price of milk, ending an eight-year supermarket price war in the name of helping farmers through the drought”.

As you can see, political pressure works with these big companies. We need more of it, but it needs to be of a wise and timely kind. These kinds of actions seem beyond many of our less-than-impressive politicians.

Senator McKim is grandstanding when talking about breaking up Coles and Woolworths, but he’s not wrong in demanding that they be better corporate citizens.

And better regulation and public exposure of all our big companies that have excessive market power, and who wield it against the public interest, should be named and shamed. In that way, McKim is contributing. But gaol? Give me a break!