The fear of losing a job has seen a reversal of both the trend of employees wanting to work from home and also workers wanting to go bush! And while the last reading of the unemployed saw a drop from 4.1% to 3.7%, which surprised economists, this return-to-the-office trend is seen as an anecdotal sign that the economy’s slowing down.

So, in turn, it’s a good omen that inflation should keep falling and then interest rate cuts should follow. Morgan’s economist, Michael Knox, this week wrote a pretty blunt assessment of what the Reserve Bank needs to see before they’ll cut rates.

To some, Knoxy is seen as a too smart, not-so-interesting economist but they’re philistines! To me, he is a guy I’ve always listened to. When he recounts about going to San Francisco to listen to one of the world’s famous economists, Stan Fischer, to understand what’s important to central banks and what they do with interest rates, he got me in.

“Back in the day” as he puts it, Knoxy learnt that rising unemployment was the most important driver of lower inflation, especially in service economies such as the US (when Stan served as the Vice Chairman of the Federal Reserve) and in Australia.

So, one day this week, my ‘buddy’ economist put out his regular note that revealed the following: “When I got home, I added unemployment to my model of the Australian cash rate. What surprised me was that when I did so, unemployment was much more powerful in explaining the cash rate than inflation.

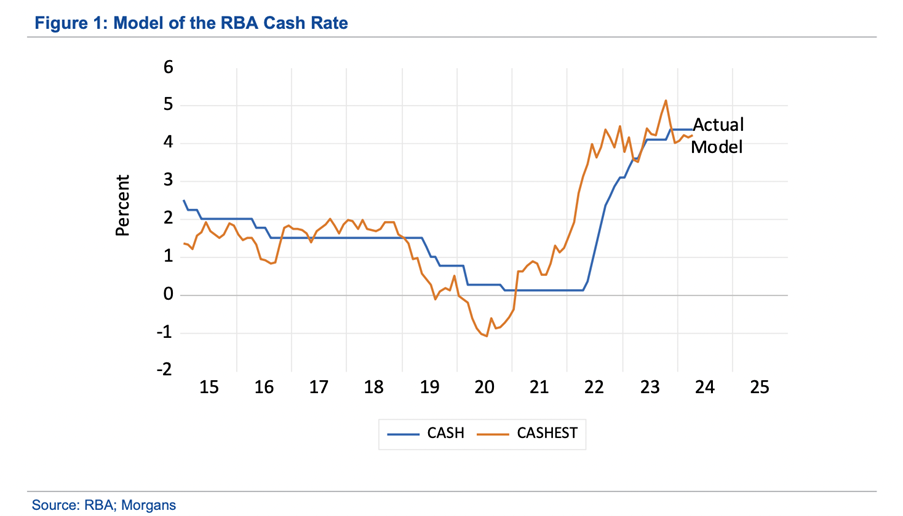

“Our model of the Australian cash rate explains 89.5% of monthly variation since the cash rate began back in 1990. A short period of our model’s performance since 2015, is shown in Figure 1. A remarkable picture of the model in the recent period is how rapidly the model moved up ahead of the up-move in the cash rate. Our model seems to lead by a touch over six months on average.”

In case, Knoxy’s eco-speak is doing your head in, let me sum up in my Switzer-style: Unemployment needs to rise more significantly to see inflation fall enough for the RBA to start cutting.

Right now, Knoxy’s view is that “the next cut in cash rate will be in November 2024. That cut will be only 25 basis points. This means that the cash rate at the end of December 2024 will be 4.1%.” The odds are he will be right unless the jobless rate surges over the next six months.

This is why these revelations from the AFR on the movement of workers back to the office is important. What did this exclusive research show?

“Average workplace utilisation rose from 31 per cent in the final quarter of 2023 to a post-pandemic high of 40 per cent in the first three months of this year, workplace sensor data provided exclusively to The Australian Financial Review shows,” the newspaper’s team reported. “The figure is the highest since the 63.2 per cent recorded in February 2020.”

Workers in the office at 40% compared to the pre-pandemic readings of 63.2% is still low but a 9% jump in one quarter is significant.

The research was conducted by XY Sense and Alex Birch told the AFR that “The pendulum has moved towards the employer, and therefore people feel more obliged to go back into work”.

Another interesting revelation was that workers think working in a hybrid way — in the office and at home over a week — is equal to a 7% pay rise!

Meanwhile, the rental benefit/saving of going bush compared to city rents went from 15% to 5% in 2021 when lockdowns changed our lives. However, by the end of 2023, the discount had gone out to 10% reflecting less demand from city workers going bush to work from home.

“Aaron Wong, senior research economist at e61, said the data suggested the 2020-22 trend of people moving into the regions was ending,” the AFR reported, “because people are finding they cannot work permanently remotely and they’re having to commute to the city at least part of the time.”

The impact of the pandemic is reducing. If unemployment spikes enough to see rate cuts come sooner than is currently expected, we could also see more workers in the office, provided they still have a job!