Infrastructure has been one of the best-performing assets in recent times. Notwithstanding the carnage on world equity markets, infrastructure is showing a positive return in 2022. That’s not a bad outcome for an asset that is traditionally less volatile (and less risky) than shares.

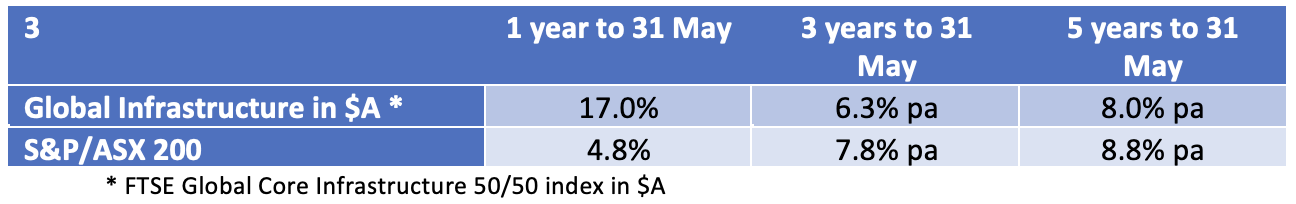

The table below compares the return of global infrastructure (in Australian dollars) to the Aussie sharemarket, the latter measured through the S&P/ASX 200 accumulation index. Over the last 12 months, infrastructure wins hands down – over 5 years, shares have done marginally better.

Strong, lower risk-adjusted returns are one of the reasons that infrastructure investments are particularly attractive to super funds. Typically, infrastructure assets have predictable long-term earnings which are often inflation-protected, with limited or very limited exposure to the business cycle. This suits super funds with their very long-term liabilities, mainly in the form of inflation-linked pension payments.

Sign up to the Switzer Report to read the full article and gain access to exclusive content like our weekly investing webinar hosted live by Peter Switzer and Paul Rickard.