In the Switzer Report, our investment subscription newsletter where Peter (Switzer), Paul (Rickard) and other respected veteran finance writers give you their considered thoughts on buying and selling shares, the topic of gold raises its head from time to time, especially during these COVID affected times when investors consider moving out of shares and engage in a practice called “flight to quality”.

In the Report yesterday, Rudi Filapek-Vandyck from FN Arena wrote this: “Ord Minnett is positive on the outlook for gold and maintains a US$2,000/oz gold price forecast for the December half. However, a strengthening Australian dollar has been playing spoilsport, adds the broker, eroding margins and leading to near-term downgrades in earnings forecasts.” He then added Ord Minnett’s view on three gold stocks:

1. NEWCREST MINING (NCM) was upgraded to Accumulate from Hold by Ord Minnett

The broker has upgraded its rating for Newcrest Mining to Accumulate from Hold with the target price increasing to $35 from $34.

2. REGIS RESOURCES (RRL) was upgraded to Hold from Sell by Ord Minnett

Regis Resources' rating has been upgraded to Hold from Sell with a target price of $4.80.

3. SARACEN MINERAL HOLDINGS (SAR) was upgraded to Hold from Lighten by Ord Minnett

FY21 production guidance for Saracen Mineral Holdings has been downgraded led by the Super Pit JV. Ord Minnett upgrades its rating to Hold from Lighten with a target price of $4.70.

Each month, via Zoom, subscribers to the Switzer Report gather to hear Peter and Paul’s views on stocks. Attendance numbers since COVID have been huge, as investors are keen to know whether to buy, sell or get on that flight to quality (one of the few flights operating these days!). Each month, the redoubtable duo invite a guest and then Russian roulette begins for the trio as subscribers shoot their questions, one of which was gold.

Jun Bei Liu, portfolio manager at Tribeca Investment Partners, was their recent guest and bravely took the first shot, when asked about the glittering metal.

“Gold is in my portfolio. I always have a bit of gold there because it provides that diversification,” she said.

“It doesn't move the same way as the market. Gold is defensive against market risk and provides the inflation hedge as well. It almost works on both ways. When there's so much money being printed around the world, gold really holds its value. It's always something I’ll hold in my portfolio but not a big position,” she said.

But when Peter asked Jun if she’d buy it now on the supposition that the price could go a lot higher, she replied: “No. Over a long period of time, yes. If you take a 12 or 24 months’ view, yes. But in the short term, remember when we talk about rotation, if we have a vaccine, if this whole reopening happens, you’ll see aggressive sell off across gold, across growth and piling into the ‘stuff’ that has underperformed. Just be mindful of that. You've got to take a longer-term view with gold,”she said

And when asked about specific stocks, she replied:

“Saracen is a bit expensive but it's the best quality management team that actually delivers. Another one to look at is Newcrest. Newcrest has relatively underperformed. It's cheap enough. It has good reserves. Look at that one as well,” she said.

At the mention of Newcrest, Paul popped into the discussion:

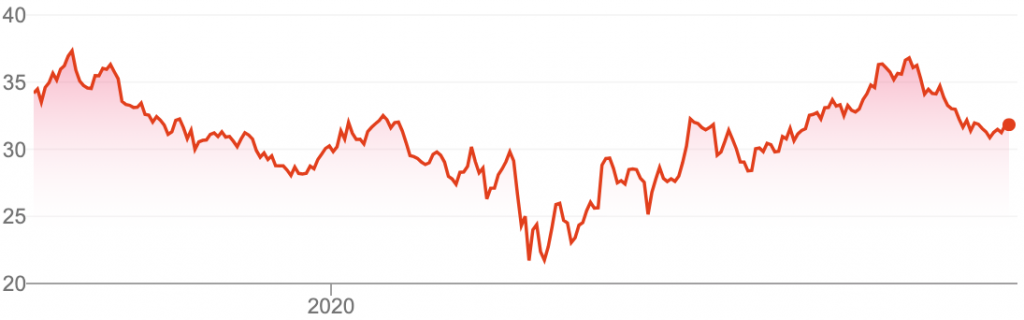

“Newcrest is also big in copper and other things, isn't it? Is copper its other main mineral? So it really hasn't done much. If you look at that chart, it has underperformed compared to the other gold majors,” Paul said.

Jun Bei came back with her usual confident reply:

“You're right. Newcrest is probably the best opportunity. They’ve had a lot of issues. The execution isn't great but that's why the share price underperformed now. It does represent a pretty good opportunity,” she said.

Another feature of the Switzer Report is the ability for subscribers to send in questions and Paul religiously answers them. Here’s a gem of a question about gold from yesterday’s Report: Has the boat sailed for gold? To which Paul replied:

“I don’t think the “boat has set sail” in relation to gold. A lack of confidence in the USA, the soaring US budget deficit, zero interest rates, weak US dollar and bourgeoning US money supply are the drivers behind the gold price.

“In terms of playing gold, I prefer ETFs such as GOLD, QAU or PMGOLD, or the outright bullion. Shares in gold miners just bring in an additional complication – production issues – and of course, are more leveraged,” he said.

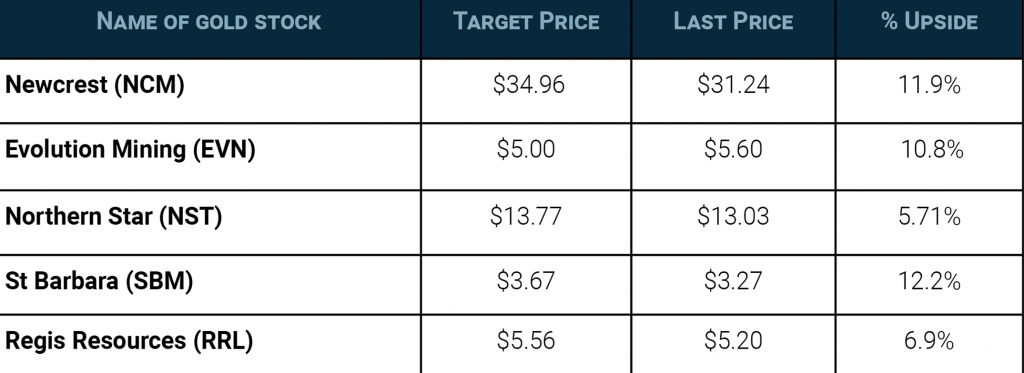

Paul then listed the big five gold miners, their consensus target prices (from the major brokers), and upside/downside relative to current share price:

So there you have it! If you were at the webinar, and read the Switzer Report yesterday, a smart investor might see a common threat here and in a word, the convergence would be — Newcrest!

No tip is ever foolproof but our three tipsters do their form and are experienced market players, which seriously reduces any gamble when it comes to buying shares.