The market is set to move higher today and by week-end deliver a two-month rally following a positive lead from Europe as it digested positive sentiment from the US Federal Reserve on the slowing pace of inflation.

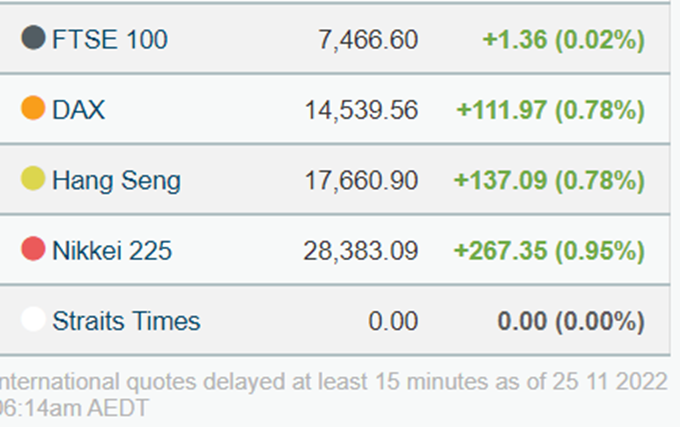

As of this morning, the SPI Futures S&P/ASX200 was up 10 points or 0.14% as the Pan-European STOXX 600 gained 0.5% overnight to close at a three-month high. European bourses across the board moved higher but US markets were closed for the Thanksgiving holiday.

Source: nabtrade

The upbeat momentum in markets followed US Federal Reserve’s minutes on the board meeting held earlier this month, where a substantial majority of members indicated they believed the US fight against inflation was showing signs of success, allowing a shift to more moderate rate hikes going forward.

It was a sufficient lead for European markets to absorb news that continental Europe had officially joined the UK in recession, although PMI data released indicated business growth had only shifted moderately lower.

Locally the ASX200 has put on 1.49% over the past five trading days to Thursday’s close of 7241.80 points and needs to gain another 2.72% by year end to move into positive territory year-to-date.

Even if that is achieved, there are still considerable headwinds for the momentum to continue into the new year.

For starters, inflation globally remains the number one risk to economic growth. The uncertainty stemming from the war in Eastern Europe and its impact on energy markets remains a risk for further inflationary problems, as does continued supply chains restraints.

Any resurgence of inflation would but an end to optimism markets took from positive Fed comments and reopen debate on whether the Fed can successfully engineer a soft landing for the US economy.

A hard landing, accompanied by rising unemployment would have significant repercussions for equity markets and the outlook for corporate earnings.

China is also a wildcard as it will be impacted by slowing global growth and recession in key markets, as well as ongoing domestic slowdowns caused by the nation’s fight to achieve zero COVID-19.

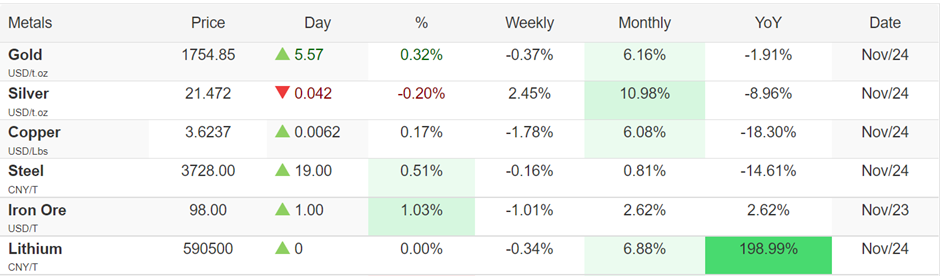

Any downgrade of China’s outlook will impact commodity markets, which have generally moved higher over the past month as China relaxed a range of COVID-19 restrictions following a downturn in infections from the latest outbreak.

Source: Trading Economics

That upward momentum in commodity prices has seen a strengthening in the Australian dollar but not to the extent that might usually be expected, due to the interest rate differential between Australian and US interest rates and the strength of the US dollar as a ‘safehaven’ currency in times of uncertainty.

Source: nabtrade

As a commodity currency, the AUD has been under pressure this year as fears of recession in the UK, Europe, the US, and China weighed on the currency. It is still struggling to break through the US68c barrier but may edge a bit higher towards US70c if the positive sentiment currently being enjoyed continues.

A quick snapshot of key corporates yesterday had mining giant BHP Group (BHP) up 1.43% to $44.55, while in healthcare Ramsay Health Care (RHC) was 0.77% higher at 64.40. In building materials Boral (BLD) was flat at $3.03, while insurance group QBE Insurance Group was 0.78% higher to $12.95.

Banks did not have a great day, with Commonwealth Bank (CBA) off 6c to $108.01, NAB down 7c to $31.23 and Westpac (WBC) off 21c to $23.87.

Analysis as at 25/11/2022. This information has been provided by WealthHub Securities Limited ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities). WealthHub Securities is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL No. 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.