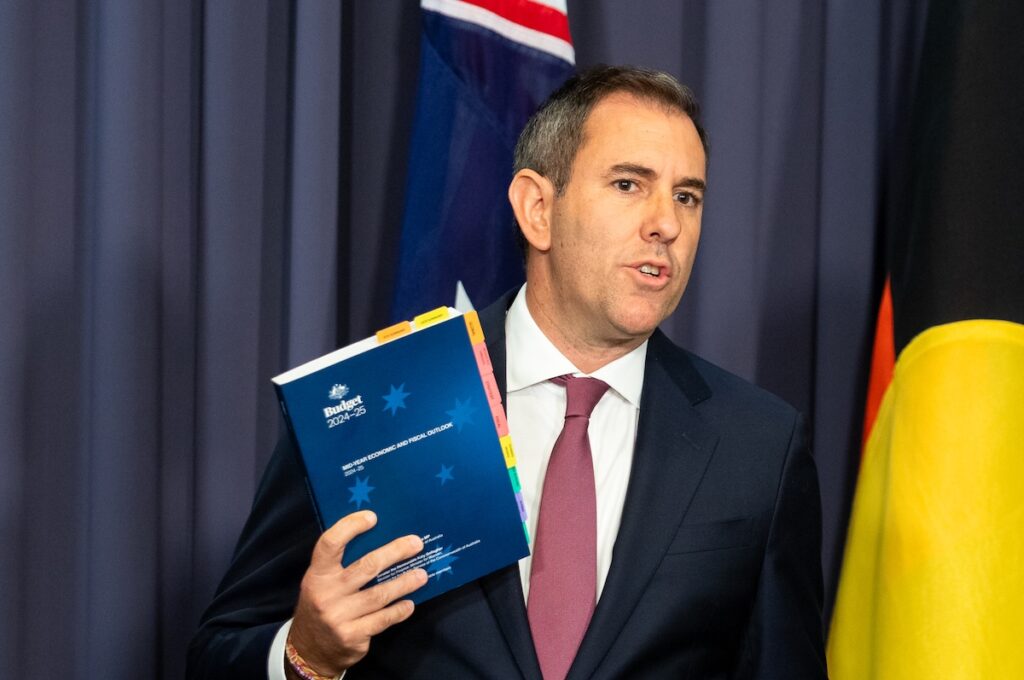

In a bid to keep the Super Tax train on the tracks, Treasurer Jim Chalmers dropped a new version of the legislation on the Friday before Christmas. What a gift. This isn’t a minor update, either, it’s big bikkies that fundamentally changes how the Super Tax works. Here’s how the new version affects you. This is the Super Tax explained.

What’s changed? The quick summary

The new exposure draft of the Super Tax legislation gets right some of the things that the original legislation was getting very wrong according to its critics.

First, there’s now no tax on unrealised gains. Then there’s a new $10 million threshold on top of the $3 million threshold for those who will cop the tax itself. And unlike on the old versions, the new Bill sees these thresholds tied to the CPI (to the cheers of critics).

Finally, timing shifts so everyone can get their affairs in order before it kicks in from the 2026-27 income year.

There are a bunch of other little changes too. Read on below to learn more.

What is the “Super Tax”?

The “Super Tax” is our little shorthand for a new tax created by the Albanese government targeting those with large Super balances. Formally, it’s known as the Treasury Laws Amendment (Better Targeted Superannuation Concessions) Bill. Catchy.

In its simplest form, the Bill creates the Division 296 tax targeting those with over $3 million and now $10 million in their Super. It won’t look to cap how much you can hold in Super, and it doesn’t mess with your contribution limits. Instead, it reduces the concessional tax treatment applied to part of the earnings associated with large balances.

Under existing rules, most superannuation earnings are taxed at up to 15 per cent in accumulation, and potentially at 0 per cent in retirement phase. The government’s policy position is that once balances swell into the “large” ($3m +) and “very large” ($10m +) range, it gets hard to justify concessional tax benefits.

The government says fewer than 0.5 per cent of Australians are affected in the first year, and fewer than 0.1 per cent will face the highest rate.

You can read our previous coverage to see exactly what was targeted and when if you’re interested. What’s new is below.

What’s new in the Christmas 2025 Super Tax draft?

The government has been clear that this is not just a re-announcement of the original Super Tax. Instead it’s a revised design shaped by feedback (read: very vocal criticism) to the previous draft legislation.

In its Exposure Draft, Treasury acknowledges that the government asked for practical changes to the design and implementation of the Super Tax after hearing all the whinging.

But rather than one or two simple changes, there are many. Some actually serve to reshape the tax entirely.

New Super Tax thresholds

Under the revised draft, the Super Tax now operates across two balance thresholds rather than one.

The first threshold remains at $3 million. Superannuation balances up to this level continue to receive the existing concessional treatment, with earnings taxed at up to 15 per cent.

For balances between $3 million and $10 million, an additional layer of tax applies, lifting the overall tax rate on that slice of earnings to up to 30 per cent.

A second threshold is introduced at $10 million. For balances above this level, a further 10 per cent tax applies, lifting the overall tax rate on those earnings to as much as 40 per cent.

No more taxing unrealised gains

The removal of unrealised gains from the tax base is potentially the most consequential technical change in the new draft. I can almost hear the crowds cheering from here as I type.

The original legislation relied on changes in value as a proxy for earnings, which meant unrealised gains and losses could trigger tax. The 2025 draft goes in a different direction.

Under the new draft legislation, funds calculate their realised taxable earnings and then attribute a share of those earnings to individual members above the thresholds.

Thresholds are now tied to inflation

Again, is that more cheering I hear?

The 2023 bill fixed the $3 million threshold in nominal terms, meaning inflation alone would have pulled more people into the tax over time.

The revised draft indexes both the $3 million and $10 million thresholds to inflation.

The stated intent is to reduce bracket creep and maintain relativity over time.

It’s likely to be music to the ears of Greens MPs and Senators alike who specifically had indexation on their list of boxes to be checked should the Government ever want them to vote for the thing.

SMSFs have to calculate their earnings differently

One of the quiet but important changes in the new legislation is that it openly accepts different super funds will calculate and report earnings in different ways.

For large retail and industry funds regulated by APRA, the government allows earnings to be attributed to members on a “fair and reasonable” basis. These funds pool assets across thousands or millions of members, often across multiple investment options. It is not practical for them to track realised earnings at an individual asset level for each person, so the law lets them estimate each member’s share of earnings using fund-level data and agreed principles.

For members, the trade-off is straightforward. You won’t see a precise, asset-by-asset breakdown of how your Division 296 earnings were calculated, but you also won’t be required to do anything yourself. The fund does the work and reports the result to the ATO.

SMSFs are treated differently because they operate differently. Self-managed super funds are small, closely controlled, and typically hold specific assets that trustees choose and manage directly. Because of that, Treasury considers they have a greater ability to influence how income and gains are allocated between members if given flexibility.

Under the revised rules, SMSFs must use more prescriptive, proportionate methods to attribute earnings between members. In practice, this means earnings are shared based on each member’s interest in the fund over the year, rather than being linked to particular assets or transactions.

The upside is transparency. SMSF trustees will be able to see clearly how earnings are calculated and attributed. The downside is flexibility. The rules are deliberately designed to prevent trustees from managing asset sales, income flows or timing decisions in ways that reduce the Division 296 tax.

New integrity rules to prevent people “gaming” the system

There are other “integrity” measures that pop up in the new draft legislation, too. They’re all aimed at ensuring there aren’t any loopholes by design that allow you to potentially reduce or dodge part of your Division 296 tax burden.

The concern is that someone with a sizeable Super balance could hold their assets inside super for most of the year, then draw down or shift money out just before 30 June so their end-of-year balance falls below the threshold. Under the original design, that sort of timing could have significantly reduced the tax bill.

Instead of looking only at a person’s total superannuation balance at the end of the financial year, the tax office will now use whichever is higher: the balance at the start of the year or the balance at the end of the year.

And you don’t get a year off in the event of your death, either. Your assessment is based on balance levels across the year, right up to 30 June.

These so-called “integrity rules” are part of the reason why the Super Tax now has a delayed fuse. If introduced in its current form, it wouldn’t take effect until the 2026-27 income year.

What’s next?

The legislation is still in draft, and there’s a public consultation period open until 16 January, 2026.

As I mentioned, Dr Chalmers is keen to get this one into Parliament as quickly as possible. Especially considering that it’s aimed to take effect from the 2026-27 income year.

For anyone close to the thresholds, or aiming to get there, understanding how these rules apply to their own structure and circumstances will require professional advice from a licensed financial advisor.

Make sure to chat to yours about what this new Bill would do if it became law so you aren’t caught out.